Archive

Reserve Bank Still Too Optimistic

Obvious signs of impending recovery... NOT!

The Reserve Bank of Australia (RBA) has released its May “Statement on Monetary Policy”, where it continues its up-beat report on Australia’s economic prospects in the face of the global financial crisis, pulling together all the positive evidence it can muster to support the idea that a recovery is closer than around the corner:

Reflecting the recent signs of stabilisation in the global economy, sentiment in financial markets has improved in recent weeks. Global equity markets have risen by around 30 per cent from their troughs in mid March, with a number of financial institutions reporting better-than-expected profits. There has also been a further easing of credit spreads, and businesses and financial institutions have found it easier to issue debt. Encouragingly, over the past month, a number of banks – including those in Australia – have been able to issue long-term debt without a government guarantee.

There is a lot of reassuring economic news of late. In addition to the things mentioned by the RBA, including the quite mild assessment of US banks by the Government “stress-test”, showing what is a very small capital short-fall of less than $80 billion dollars. I say small, because, considering that the future value of the US dollar must be much lower than it is now (after the new money issued by the Fed over the last year washes into the world economy), $80 next year might feel a bit more like $20 now.

RBA’s point, though, is that the size of unemployment shifts, price shifts and activity decline is small compared with elsewhere. Housing prices have not yet crashed in Australia in the way they have in the UK or the US. Recent unemployment figures even showed a decline in the jobless rate (although the statistics are disputed). Banks in Australia claim to still be in a healthy state (as a result of the lack of housing crash). One point it makes to support its case is the rate of inflation, at around 4%, which is roughly where the RBA has its interest rate. This has happened due to higher import costs, because the Australian dollar has fallen in value.

The RBA report reads as though, in their opinion, the whole economic crisis is rather overblown (using terms like ‘ongoing risk aversion’) and that there is less substance to it than the numbers might indicate. It cites less ‘bad’ numbers coming from China as signs that the market is improving:

The clearest signs of improvement in economic conditions are from China. While on a year-ended basis, Chinese growth slowed further in the March quarter to 6.1 per cent, RBA estimates suggest that the pace of quarterly growth picked up in the March quarter, and other indicators of activity generally tell a similar story

The question is, though, where is demand for Chinese stuff going to spring up from? It’s doubtful that it will be the old. credit based sources in the US which no longer exist. Also, how much can we trust China’s figures? Do we also believe the official line on other things like human rights, territorial aims, military capability and so on? If China is recording a rise in production, why are similar classes of producers, Philippines, Thailand, Japan and Taiwan recording ongoing massive falls in production?

Big Bad Deficits

It is not difficult to imagine that if prices fell low enough (and there has been deflation in prices in major economies), and if consumers held off spending on essential items, they would eventually come out of hiding and buy some of those goods: clothing for the coming Summer, cars, and so forth. Population shifts occur continually and this spurs some demand for housing, even in depression times. They are not, of themselves, signs of the next economic boom, or even recovery.

The IMF is forecasting slight growth in the large economies, by and large, but this is on the back of incredible deficits due to stimulus packages and the printing of new money. Because the IMF measures money in its current value, any growth will be nonexistent when currency devaluation ensues.

The small tick in the massively down-trending graphs is seen by the RBA as a ray of hope, a sign of the inevitable return to prosperity in the First World.

Other issues, such as the bond market bubble and other amazing phenomena are also covered by the RBA. In short, massive amounts of new money are being poured over the world like a bucket of maple syrup over a scoop of ice cream, through the miracle of fractional reserve banking and thanks to fiat money. The catch is that it’s imitation maple syrup, much of it made with artificial sweetener.

This is the big problem with how governments have dealt with the financial crisis. Fiat money has to ultimately find backing in real things, such as goods, good will, and physical force. If these things are not forthcoming, or if there is a major imbalance in them, then no amount of money printing will put it right. Real problems ultimately need real solutions.

In the current economic situation globally, the problem is not that of recession, which consists of a market correction to undo various imbalances that develop in an otherwise healthy and believable financial system. The fundamental problem in the crisis is that the amount of money people say they have, and the tangible things they can use to back up that money, are seriously out of balance. For example, America no longer produces enough goods to exchange for the goods it imports. It has lost its moral authority internationally as a result of many serious scandals. Its military superpower is lessening and may well be eclipsed in a year or two. China’s goods need to find new customers, and China is very aware that its US dollar reserves are soon to be savagely debased, unless, of course, something dramatic happens outside the sphere of economics.

Domestic circumstances are far from natural, currently, as a result of the Australian Government’s stimulus packages. This, for example, has resulted in the mitigation of the housing correction, where the low-end of the market is now recording a growth in prices, funded by the ever more generous First Home Buyer’s Grant (FHBG). The RBA calls the housing market a “softening” rather than a correction, because it probably does not hold the opinion that housing prices in Australia are excessive:

Looking ahead, low mortgage interest rates and the increase in grants for first-home buyers have made home purchase more affordable, and this is expected to help support residential building construction in the second half of 2009.

The problem is that the FHB housing boom, occurring in the face of a global economic depression, is entirely credit based. The FHBG is based on Government debt and the rest is private debt. In other words, the lack of housing crash in Australia is happening on borrowed time and borrowed money.

In the commercial sector, things are less artificial. Empty offices accumulate and their prices fall.

But there is something to the RBA’s positivity. Australians still eat, and demand for farm produce continues to rise. Also, because prices of imported goods have risen, Australia is importing less. This has managed to buffer the fall in exports, so that a trade surplus might result. In the background, however, is the looming shadow of government deficit which is set to skyrocket. Claims of a fall in unemployment need to be taken with a grain of salt as well, since this has not been backed up by an increase in job advertisements.

Saving rates are rising in Australia, which is a great sign (a sudden outbreak of commonsense?), but ultimately, this is not the business model for banks and governments, whose aim is to issue debts and charge interest, encourage the movement of money and the tax collection that results. To that end, bank bonds are being issued again without government guarantees, suggesting that, for banks in Australia at least, business as usual is resuming. That is, for the time being, and to a small degree. It appears to represent a spike in loan approvals as a result of the FHBG, which itself is a mini-bubble which will likely pop into the next financial year.

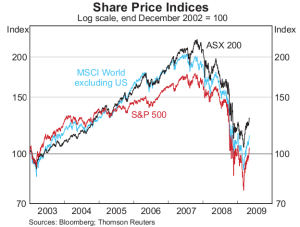

Why did they have to make the scale logarithmic?

The stock market is the main indicator used to suggest impending recovery, driven by the resources sector. Resources are tangibles, and in a depressive economic climate, it was predicted that companies in that sector would fare better than the rest of the Australian economy, because demand exists for resources within China itself which is cashed up. Otherwise, even during the boom, Australia’s performance was lackluster in other areas apart from finance and real estate. Bank profits are still high also, as a result of not passing on interest rate cuts. These positive trends do not reflect any improvement in the way Australia’s economy is run. Rather, they are a result of the banks screwing consumers, and a dip in the Australian dollar value. Calling the bottom of the market at this stage, although popular, is not particularly convincing.

In summary, it appears that the RBA has somewhat tempered its optimism over its previous reports. The idea of a V shaped economic recession is being recognized for the fantasy that it is, but the analysis still fails to take into account the big questions of how the US expects to climb out of the debt hole it is still digging for itself at a frantic pace, or how other nations will respond to the US Federal Reserve’s “fiscal easing” policies, reminiscent of the Weimar Republic.

Our expectation would be that the world economy will not see as sharp declines in the next year or so as has occurred in the last six months, but that any recovery is a very long way off. This is not because the economic stimulus packages around the world will fail, which they are destined to in the long run, but because “recovery” is not the likely outcome for many of the nations that are expecting one. Rather, there is sure to be a major shift in the global balance of power, economically, politically and militarily. People don’t like to think of war in a rich country as a possibility, and mentioning it always raises eyebrows, especially on a clam day with the warm sun shining overhead. Nonetheless, since American money has been exposed as a farce, the card players at the table have quietly put their cards down and are reaching for the holster. A conflict may develop rapidly, and not necessarily at a time of America’s choosing. It is this scenario that makes one a skeptic when reading the RBA’s rose colored view of the world.

(Graphs are sourced from RBA’s report. Download the full text of the RBA assessment here.)

Australia’s Economic Calm Before the Storm

The RBA now admits that Australia will enter an economic recession this year, whereas there has been evidence that the Government’s bailouts have worked in reducing mortgage stress. This was probably not the intended effect of Kevin Rudd’s stimulus packages, but certainly a win for working Australians who, in their wisdom, put the cash in the bank instead of splurging it. However it is still remarkable that the RBA thinks Australia will sail through the global recession without many scratches and bruises. How do they think this will happen?

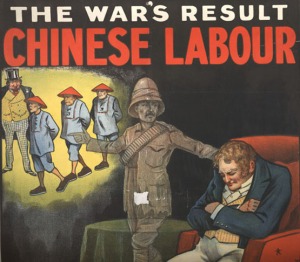

The Rudd “stimulus” money many received was arguably an unconstitutional act and is being challenged as such in the courts (a challenge which has since failed). It also appears that the money arises from foreign borrowings, such as from China. Although Australia is not engaged in a Cold War with China, genuine questions arise as to how this all impacts on the national interest, on security financially and militarily. More and more parallels with Gough Whitlam’s era are being used to place pressure on the current Government, but few of these relate to the probable real reasons for The Dismissal. It’s not likely that Kevin Rudd will be toppled any time soon, as far as any public information indicates. Time can only tell.

What could be expected, however, is a curtailing of “freebies” this year, followed by rising inflation over the next year or two. The shear enormity of money being thrown about in North America (expansion of the money supply from $850 billion to $4 trillion) cannot go unnoticed. It is inconceivable that this kind of desperate money-printing won’t result in hyperinflation in the US, with knock-on effects abroad. It could even spell the end of the US Dollar altogether, with louder and more direct statements supporting the abandonment of fiat currencies. This in turn should raise alarm bells with regard to the likely geopolitical fall out of America’s demise as an economic and political power. It won’t take long for America’s military to follow suit. Chess pieces will start moving all over the place, with potentially horrific effect.

How will all of this affect Australia?

It is quite possible that what is coming will surprise even the pessimists. Nobody in the Australian media is considering the ramifications of war breaking out. It already has in some ways. The rise of Internet based espionage should be taken as an important signal. The lines are being drawn as to who is becoming whose enemy on the international level. Other attacks have been so broad that the culprit will probably never be identified, nor the damage caused known. It’s a cluster of events whose timing is interesting, but there is likely to be much more activity in this regard than the public can ever be aware of. I guess one can only hope that so much information has been leaked to so many that nobody will have the confidence to attack anyone else, resulting in accidental peace.

The effect on Australia of North American and European financial turmoil has so far been quite mild. There are no major demonstrations, no big shifts in unemployment figures, no mass-defaults on mortgages. What has to be understood, however, is that the international economic crisis cannot end overnight. It will play itself out over years and will likely spill over into social and military conflict. The Australian Government cannot prop up businesses, households and banks for that long. It will have to flinch and let things go the way they are destined to. Soon, what we read in the newspapers about far away lands will become realities at home.

Australian Housing Disinformation

Know Thy Banker

A short note today on the difference between the RBA’s comments on the stability and durability of the housing market and, well, reality:

The Reserve Bank said Australian banks had been able to concentrate on profitable and relatively safe domestic lending to households over the past decade. They had not lent heavily abroad, where risks are higher, and they had avoided exposure to securities, such as collateralised debt obligations, that have brought such heavy losses to other banks.

How can they pretend that Australian household incomes are immune from international events? The difference between foreclosures on Australian mortgages and those overseas is one of timing and not necessarily magnitude. Claiming that we will survive this worldwide depression like we survived the other, smaller recessions, is nothing more than a random statement. Nobody really knows that.

It’s no secret that the New Zealand economy is in a terrible recession, and everyone is aware of the economic collapse in Ireland, Iceland, Eastern Europe and, it appears, even the United Kingdom. It’s now official news that Australian wealth fell by as much as 38% over the past twelve months. Unemployment is already rising and there is no evidence to support the notion that the trend won’t continue.

If we separate opinion from fact in all of this, we can see that the RBA has plenty of opinion but not much fact behind its confidence in Australia’s real estate market survivability. At the very least, the RBA is tight-lipped on how it arrives at its optimism.

Part of this optimism may come from Chinese investment into Australia which is a particularly smelly bucket of fish:

Market insiders believe China is buying 15 to 20 per cent of the $2 billion in Treasury securities being issued every week.

This would make China the single biggest lender to Australia, although details of who owns the bonds are cloaked in secrecy.

The program, authorised by Treasurer Wayne Swan, will leave Australia with a debt bill approaching $200 billion.

Our Government is playing a very dangerous game in doing so, and any assumption that China won’t want its pound of flesh in return would be foolish indeed. In a way, all this is a bit like taking out a mortgage to buy the kids a Playstation, a swimming pool, and some other expensive entertainment thingies, all in the face of impending unemployment. Hey, we might be lucky and not get unemployed!

Can this all be a reason to hope that real estate prices in Australia won’t fall? It cannot be, because ultimately, borrowed money has to be paid back and the artificial propping up of Australian living standards through foreign debt is not sustainable, even in the medium term, because economic resurgence has not yet occurred anywhere in the world. The stock market rally in the US is not to be taken seriously, as there is no fundamental reason behind it. Where are the glowing US trade figures? Where is the news of factories reopening, or of a jump in forward orders for commodities?

Australia is only in the early phase of the economic storm. Good economic news that is not based on indisputable fact should be considered to be nothing more than disinformation.