Wikileaks

Here are a few things to keep in mind when trying to make sense of Wikileaks and all things Assange:

- The best lies are laced with 95% truth, (plus statistics). Especially juicy, embarrassing, gossipy truth.

- Who benefits? Whose life is improved by these revelations? Who is attempting to create a leadership vacuum… are they a better alternative? Will We The People benefit?

- Just because someone is anonymous does not make them truthful, honest, or necessarily on the side of ordinary people in general. Those who leaked the information to Wikileaks provide no evidence of any of these redeeming qualities.

- Because Wikileaks does not disclose its network of benefactors, it is no more transparent than the mainstream media.

- Isn’t it odd that Wikileaks is working with mainstream media outlets in the first place?

Compare Assange and Wikileaks this with the great agents of good in history. Although many radical movements resisting oppression may appear anarchistic, in that their goals require some degree of social disruption, they differ in that they have the ultimate goal of righting wrongs and they usually state the kind of order (including some kind of peace) which they seek to establish, whereas anarchists set about merely to destroy. They reject the fact that society needs a system in order to succeed. Supporting them is like buying a product you are told nothing about. Anarchists in history have frequently been a mere tool of a hidden hand. If too many people believe too much of what Wikileaks is releasing, then there will be so many pretexts for war that death is guaranteed. This is not in humanity’s interest.

Historical Repetition?

It’s obviously not easy being a politician. It takes training from an early age and political success partly relies on memorable imagery. This one of Julia certainly is memorable!

Global Falsehoods

Head Butt

We live in the age of falsehood. Take any stated claim of the mass media that is not self evident, invert the meaning of what is said, and you will find yourself closer to knowing the truth than before.

The rate at which an accepted Truth changes nowadays is astounding. The ability of people to endure it may appear even more astounding, but there is a simple explanation, and a single term which contains the answer: cognitive dissonance. It is a psychological tool of deception that is being used increasingly and at every level. People can be trained to accept contradictory (or patently false) ideas through social pressure, for example.

In the cases we present here, the concept of cognitive dissonance is being used to make the public accept blatant falsehoods, probably for nefarious purposes.

Nobel Peace Prize awarded to Warring President

It appears now that the problem with George W. Bush was not what he said, nor what he did, but the way he did it and said it. Barack Obama is continuing along practically the same course as his predecessor, perhaps even more radically, but he’s a smooth talker and his team of spin-doctor-crats are better at waltzing the world into a wider Middle Eastern conflict, again under their totally butchered definition of “peace making”. It’s with such finesse that Obama is performing his given tasks that his masters have seen it fit to crown him with the Nobel Peace Prize. It’s an hypocrisy that is not new, and should not really be a surprise. There is no requirement for there to be any real notion of pacifism to be awarded the prize. You just have to be the darling of the Establishment.

In Obama’s case, he voted consistently for the increased funding of America’s various wars, voted to commend the armed forces for incidents which resulted in mass civilian casualties, opposed the withdrawal of troops from Iraq and Afghanistan, and voted for the appointment of pro-war candidates to key positions, such as the case Robert M. Gates who espouses pre-emptive war. Henry Kissinger, also controversially awarded the Nobel Prize in 1973 (for negotiating peace in Vietnam), at least had the sense of embarrassment to attempt to withdraw his acceptance thereof after he was shown up by Le Duc Tho, also awarded the prize, who rejected the award because peace had not yet been achieved. Obama, having no sense of shame, accepts this award even before he has had any chance to show whether he is anything but a man on the war path.

By swallowing the notion that Obama is a peacemaker, the public is rendered ever more naive and ignorant. The US Administration pursues its war, rendition and torture programmes unabated, only without the protests. The public is being massaged into accepting blatant criminality.

Economic recession declared magically over

It was announced today that, for America at least, the recession is over. It’s time to spend those dollars, because happy days are back again, but is it really true?

In calculus, one studies the slope of a curve, rates of change and rates of rates of change and so on. This allows economists to butcher the truth by studying whatever degree of change that suits them. A downward line might be good because it’s not getting worse, or bad because it’s downward. It all depends on how you wish to mislead your audience. The quantity of bad news is probably decreasing at the moment, which causes optimists to be optimistic, but the quality, the nature of the bad news is the same, only rephrased. All that can be really said about the economy is that there have been changes in the rate of movement of money, but without changes in the fundamental structure of economies.

The Bank of International Settlements in its September 2009 Review states:

The second quarter of 2009 saw a small rebound in activity on the international

derivatives exchanges, although trading volumes were still well below the pre-

crisis level two years before. Total turnover based on notional amounts

increased to $426 trillion from $366 trillion in the previous quarter, consistent

with a return of risk appetite.

This can be interpreted to mean that the sun is shining and butterflies are chasing the smell of nectar, but there are many who have claimed for some time that a derivatives crisis is just around the corner. The continuing inflation of the derivatives bubble exposes the reckless abandon of those taking part. Given the massive numbers involved (hundreds of trillions of dollars), a device is being set up which, if it crashes, will dwarf any economic disaster we have seen.

What the renewed derivatives boom represents is the bet (by retailers, banks and others) that times will definitely be rosy in 2010 and beyond. The optimists think they will beat the pessimists (or rather, the hard nosed realists). The whole thing hangs on some important things going right, namely that inflation will not spiral out of control, that interest rates remain low and that unemployment does not blow out. If consumption doesn’t pick up, the bubble goes pop, because pretty soon, with interest rates rising, mortgages will start defaulting again, businesses will close and banks will find themselves high and dry. This is actually a likely scenario, if one takes a look at price versus earnings at the stock exchanges, or if one looks at how much debt had to be taken on by governments to support local employment (frequently in economically destructive ways, such as the demolition of cars before the end of their useful lives), or if one looks at what has changed about consumer habits.

So in simple terms, the economy is “recovering” purely through debt expansion, occurring largely out of sight of the public. Was not debt the cause of the crisis in the first place?

It’s either a riddle or a lie. There can only be a real recovery from this economic crisis through real, structural economic reform. This has not taken place. Our hunch is that the current rally is still a sucker’s rally.

By swallowing the notion that the economy is back on its feet again, the public is fooled into taking excessive risk. If you believe this recovery, you are leaning into a false wind. The public is being set up for a fall, all of which appears to be aimed at removing freedoms and sovereignty.

Death By Climate Change

The sky is falling in, as it always has. Back in the 1970’s, we apparently were going to all freeze to death. Recently, of course, we were told that we were all going to boil to death. But we now see that the ice caps are far from melting. Nobody seems to have a clue where climates will be in 25 years. This seems to be largely due to a lack of understanding of the degree of influence on temperature of geothermal and solar activity, and other natural phenomena.

This still doesn’t stop the political activists of claiming that we are all going to die of, well, climate change. See, now it doesn’t matter what happens, they were right and they can say “we told you so!”

The public is being made to feel guilty and culpable for hot summers, cold winters, rainy days and sunburnt grass. As a result, the public is made to accept whatever completely ridiculous and illogical carbon trading system the various governments dream up. Instead of sensible endeavours (regardless of climate change), such as improving transport infrastructure to be simply more energy efficient, building better houses and having fewer cars, governments are using climate as a way to amass power and money (through taxes).

In summary, cognitive dissonance is a useful thing indeed! But luckily, exposing it breaks the spell.

Without cash, gold can have no monetary role

Cashless Beast

Although the topics of the Cashless Society and the Gold Monetary Standard have been discussed previously on this and other sites, we feel that further discussion on these pressing issues is warranted.

The Cashless Society

Earlier we speculated that there might be a glorious return to sound money, such as a precious metal standard. But you can forget about gold as a real standard to moderate the issue of money. Not because it’s not a good idea. A gold standard is a fantastic idea, but it will not come about, because the finance industry has something else in mind. We all know it’s coming, but it has been somewhat forgotten as a discussion point. Yes, we mean the Cashless Society. Every monetary transaction is moving to electronic form.

Back in 2007, credit card Visa chief Peter Ayliffe predicted that a cashless society (in the UK) would come into being by 2012. It may not seem like a sure thing, but the timing of such a prediction is worth making a note of. The problems of electronic transactions at the moment are that financial institutions are making too much money from surcharges and fees, keeping cash as a more attractive way to buy small to medium priced products than plastic. During the current artificially created economic crisis, there has been a contraction of credit, but the idea of eliminating cash is still high on the agenda, even at the UN. The impediments to a universal cashless system can be removed overnight: remove fees on electronic transactions, and impose unreasonable fees on obtaining or depositing cash. Within a couple of years the system will be locked in, and nobody will take cash any more.

Introduced as part of the national e-Governance initiative, the e-Purse, embedded on national ID and resident cards, is the first of its kind in the region. Implemented by the Royal Oman Police (ROP), in association with the Information Technology Authority (ITA) and BankMuscat, the national e-Purse project will revolutionise cash transactions.

…

“Being an identity card, the e-Purse always remains with citizens and residents. Whenever e-Purse is used, the identity of the user is verified and the government can track each transaction. The support from ITA to the e-Purse project is in line with the directive of His Majesty Sultan Qaboos bin Said to enhance e-government services in Oman,” [Dr Salim Al Ruzaiqi, chief executive officer, ITA] added.

The cashless society is a government’s dream. Tax evasion becomes practically impossible, resulting in substantial gains in tax revenue. In theory, the purchase of dangerous substances and weapons becomes more easily traceable to individuals, making criminal activity increasingly difficult. Except for bartering, which is difficult to conduct on a large scale, the economy becomes completely accountable. Not a cent is lost, and society becomes unable to avoid policy changes. No more armoured cars, bank robberies, muggings, bribes, illegal drugs, and so on. All of this has been claimed by proponents of the cashless society. They tend not to mention certain other obvious points which might coincide with this phenomenon, such as the storage of personal information together with the electronic money devices (be they cards or some other form of identification), such as medial information, license details and biometric data. They are already being introduced.

The cashless society would likely accompany the introduction of a single world currency. Without the need to exchange physical coins or notes, all money becomes completely arbitrary. All money would reside on computer accounts, can be given any unit value, and can be created or destroyed at will (unlimited credit). Potentially, all money could reside on a single supercomputer, to save energy.

Banks are especially poised to benefit:

“Banks are very excited about replacing cash. Smart Cards give them the opportunity to make some big bucks off interest-free loans from their customers. Once a customer transfers credit to a cash card, the bank can stop paying interest but gets to hold on to the cash until it’s billed by a merchant. If 100 million people used a card with an average of only 10 unspent dollars on it, the banks would reap $1 billion a day of interest-free money to invest.” (Forbes Magazine, 1998)

Then of course is the argument for the implantation of microchips, or some other physical and permanent means of identification. The technology is indeed ready and has reached a mature status. It is only society that is not yet ready.

The truth of the matter is, of course, different. Many of the arguments in favour of the cashless society are false, where the truth in many cases is diametrically opposed to what is claimed. So what problems might exist with the Utopian dream of universal electronic funds transfer?

Most of the logistic problems are covered elsewhere, and can be easily thought about. Aside from the fact that private transfer of money becomes impossible without the involvement of the universal infrastructure, the other problems are identical to those that plague electronic money transfers already. Identity theft is the biggest problem, and it continues to occur as computing systems become ever complex and bug-ridden.

From our point of view there are three major threats to ordinary people arising from a cashless monetary system. Some of these can already be appreciated, if you just imagine your life suddenly without any access to your credit or bank cards.

(Out of) Control

Could it be said that the quality of governance is directly proportional to the likelihood that the governor is deposed should he or she fail to perform? The easier it is to block the government, the better.

The motivations for a cashless society are really those of making the government of the population easier (for government) and not to ‘enable’ or ’empower’ ordinary people. Supposedly, it would cost less to collect taxes, to police fraud, to run after escapees, because all you need to do is look up the individual’s number and instantly you can see practically every interaction the person has had, each hour of each day. Tracking the movements of people becomes a trivial matter. It’s no secret that even the rudimentary magnetic strips on credit cards can be read from a distance, particularly at doorways if the appropriate magnetic coils are installed (which, in most first world retail stores, they are).

Any electronic device designed to act as a portable electronic wallet will also serve as an access key and unique identifier. It is merely natural progression to bundle passport, wallet, driver’s license, medical alerts and personal details into one key, which is synchronized both locally (on the person) and centrally (on the supercomputer). The same can be rigged to allow key-less entry to house, car, workplace, and airport departure gate. The benefits are a seamless, keyless, paperless, and no-touch life from the apartment door, to the secure car-park, into the car, into work, through the shops, to one’s overseas holiday, and all the purchases and movements there, and back. All of this can be achieved with a single microchip, either as a card, embedded in a wristwatch, or implanted under the skin.

The great weakness of a centralized, integrated and unified key system is that people can be ‘unplugged’ instantaneously and effortlessly, even arbitrarily. Physical papers, a wad of cash and a set of metal keys is a robust, low-tech and redundant way of doing things, yet the tiny gains in convenience of electronic keys (and money) come at great personal risk, because the power is completely out of the hands of the individual. Any failure of the supporting infrastructure is a total failure. It can happen at the hands of a disgruntled or corrupt employee, a hacker or an out-of-control government. The temptation to abuse such a system is immeasurable. If it can happen, it will happen.

In essence, by “holding” all of an individual’s money for him, the electronic monetary system robs the individual of all of his power. This is the ultimate form of population control. In particular, since populations now live in cities and are totally dependent on common infrastructure for their survival, the cashless society permits any kind of political and social change to be effected with no way for people to resist effectively, nor to organize against the system without being found out at a very early stage. The cashless society has the potential to transform what today appears to be a free society into a prison that is tighter and more oppressive than has existed in any totalitarian system in the past, including the Soviet Union under Stalin.

Black Box Economy

It is already problematic that the vast majority of money that is “out there” exists in the form of electrons on magnetic and solid state devices, and not as tangible wealth. We read in the news about billions of dollars being “wiped off” stock markets, and trillions of dollars sitting “on the sidelines”. All of it is meaningless sensationalism, and only illustrates the absurdity of fiat money. The fact that central banks can magic trillions of dollars of new funds into the economy in the space of a few seconds, and that the supply of credit is limited only by people’s willingness to borrow, means that the number that represents your life savings can be wiped out in seconds, by the sudden dilution of the global money supply (to name but one example). The fact that company shares are mostly traded by computers, with the value of shares fluctuating every millisecond as a result of computer algorithms and not human decision making, makes the whole business of market investment a farce.

There is no way of being certain, in an electronic economy, that anything is real. There is not necessarily any paper trail to account for the volume of transactions that exists, and a corrupt elite (which, conveniently enough, already exists) can line its pockets with limitless money, with no way of detecting or proving the crime. Forensic information can be planted or removed all too easily. Without cash, there is no way for an individual to opt out of the system by holding his money in physical form. In a cashless society, there remains only one certainty: hard assets. Everything else will have made the full transition to becoming make-believe.

In many ways, the electronic economy reflects the modern approach to morals. There is great emphasis on civics, and on the conduct of individuals in public (looking good in public), but there is no emphasis on personal moral integrity and the proper conduct of thoughts and deeds in one’s private realm. Modern society encourages personal moral depravity, and teaches a perfect hypocrisy, whereby people in public behave impeccably, yet frequently their private lives are as corrupt and vile as can be imagined. An electronic economy looks squeaky clean on the outside, but there is no telling what manipulation, corruption and wholesale theft is going on beneath. There is also no way to trust the individuals maintaining and governing the monetary infrastructure, since they are as likely to be soulless, amoral and opportunistic as society itself has become.

The Apocalyptic Vision

It is easy to laugh at religious zealots when they harp on about St. John’s Apocalypse, on things such as the Mark of the Beast, and so on. In their rush to sell a message they don’t understand, they undermine the value of the Sacred Texts, leading others to miss out on the wisdom contained therein. We quote the passage that appears to be relevant to the idea of the cashless society:

And he shall make all, both little and great, rich and poor, freemen and bondmen, to have a character in their right hand, or on their foreheads. 17 And that no man might buy or sell, but he that hath the character, or the name of the beast, or the number of his name. Here is wisdom. He that hath understanding, let him count the number of the beast. For it is the number of a man: and the number of him is six hundred sixty-six.

These dramatic passages are full of symbolism and, to some extent, allegory. Throughout the last two millennia, people have tried to torture the words to fit the situation of the day. The lesson we draw from the passage is that the restriction to trade, imposed on individuals because of a religious or political attribute, is always a bad thing. The point to be taken from the Apocalypse, however, is that the predictions apply to the entire world, not just the situation in one or another country at a given time. The point of our article, in part, is that the cashless society is a phenomenon which is capable of being imposed globally, perhaps over the space of a decade or so.

If the G20, for example, met for another “crisis meeting”, and decided, once and for all, to coalesce their currencies, they may simultaneously claim that it is cheaper not to issue any notes or coins, but to issue electronic keys, as described above. Once some heavyweight economies adopt the idea, all else will follow, or face the sword. The scenario is plausible, even though in 2009 it still seems like a pipe dream.

It ought to be noted that think tanks that guide global policy have attitudes which resemble those described by St. John.

In the closing plenary session of the [San Francisco, 1996] forum, philosopher/author Sam Keen provided a summary and conclusive remarks on the conference. Among the conference participants, said Keen, “there was very strong agreement that religious institutions have to take primary responsibility for the population explosion. We must speak far more clearly about sexuality, about contraception, about abortion, about the values that control the population, because the ecological crisis, in short, is the population crisis.

Cut the population by 90 percent and there aren’t enough people left to do a great deal of ecological damage.”

It’s had to imagine just how so many people could be killed without leaving the planet itself uninhabitable, but there is no limit to human ingenuity. There is also, clearly, an insanity at work that makes Nero look like a dull boy.

Gold Has No Place

To go back to material matters, we think once again of gold. Even if a single world currency is purportedly based on a precious metal, because this currency is likely to be cashless, the metallic standard is nothing more than an empty promise. You are trusting the same men in the same suits who are this very day swindling the planet without rest. Just as there is no living soul within the body of the modern man (in a suit), there can be no golden heart to an electronic currency.

We conclude that whatever actions can be taken to limit the progression towards the elimination of cash, should be taken. More importantly, however, it behoves every person to consider the implications of such a system coming about, and to have contingencies in place (a topic in its own right).

Haven’t Heard of Chesterton?

Gilbert Keith Chesterton - 1874-1936

The problems of the modern world do not merely revolve around whether money is based on faith, or gold, or seashells, nor whether the US has the weapons, or Russia, or China. All the problems persist, while wrong ideas persist. So it is our pleasure to add a link to our site in promotion of Chesterton.org. As the name suggests, it contains the collected works of what was arguably the greatest author of the 20th century. To that end, we quote from the website, with our emphasis in bold:

Chesterton is the most unjustly neglected writer of our time. Perhaps it is proof that education is too important to be left to educators and that publishing is too important to be left to publishers, but there is no excuse why Chesterton is no longer taught in our schools and why his writing is not more widely reprinted and especially included in college anthologies. Well, there is an excuse. It seems that Chesterton is tough to pigeonhole, and if a writer cannot be quickly consigned to a category, or to one-word description, he risks falling through the cracks. Even if he weighs three hundred pounds.

But there is another problem. Modern thinkers and commentators and critics have found it much more convenient to ignore Chesterton rather than to engage him in an argument, because to argue with Chesterton is to lose.

Chesterton argued eloquently against all the trends that eventually took over the 20th century: materialism, scientific determinism, moral relativism, and spineless agnosticism. He also argued against both socialism and capitalism and showed why they have both been the enemies of freedom and justice in modern society.

And what did he argue for? What was it he defended? He defended “the common man” and common sense. He defended the poor. He defended the family. He defended beauty. And he defended Christianity and the Catholic Faith. These don’t play well in the classroom, in the media, or in the public arena. And that is probably why he is neglected. The modern world prefers writers who are snobs, who have exotic and bizarre ideas, who glorify decadence, who scoff at Christianity, who deny the dignity of the poor, and who think freedom means no responsibility.

We think it ought to be part of every educated person’s task to be familiar with Gilbert Keith Chesterton, his writings, his thinking and his witty humour. It is becoming ever more important to promote clear, critical thinking in the face of our increasingly murky world of vague ideas adrift in a sea of insanity.

Don’t Get Drunk at This Party

The Bank

Several rather unconnected reports give a poignant lesson on the importance of true principles. That is, if you follow a correct idea through to its conclusion, it does not matter what the established facts may be at a given time, your hunch will come good.

In a not unexpected report (Financial Times), it’s announced that the G20 Summit is set to deliver a coordinated removal of the various stimulus packages that have, for the past year or so, “rescued” our economy from the “the Abyss“, as our beloved Rudd called it.

Jean-Claude Trichet, European Central Bank president, writing in Friday’s Financial Times, has outlined for the first time the principles the ECB would use to unwind the exceptional steps it has taken.

..

The OECD is forecasting that in 2009, the contraction in output among G7 nations will be 3.7 per cent, less severe than the 4.1 per cent decline forecast just a few months ago. The OECD downgraded the outlook for the UK, which will be the only G7 nation not to show growth in any single quarter of 2009.

The idea still holds true that, had there not been any stimulus packages, and had the market been allowed to take its natural course (as a side effect of an untenable and unnatural way of doing things over the past several decades), then we would have reached the bottom sooner. Arguably, more villains would have been caught off guard and not given the precious time they’ve now gotten to re-manoeuvre themselves before the safety net is removed. And the idea of saving the Government splurge money instead of spending it has once and for all proven correct. It was never going to last anyway.

Still, it’s frightening to see such unison in global economic policy. The more this happens, the more you can be assured that Democracy is dead. They have decided that, through their artificial economic “stimulus”, they have convinced enough rabbits that the sky was not really falling in. The cute little bunnies have come out of their warrens, raising their furry ears once more. They are ready once again for the slaughter, and the big slaughter machine (the Stock Market) has had its blades resharpened.

The voice of experience and wisdom is well heard in Bill Bonner’s latest Daily Reckoning article, where he says that the market (and the economy) never reached its true bottom:

We say that because stocks never went low enough to qualify for a genuine bottom…and investors never showed the kind of disgust that you usually get at real bottoms.

We say that, too, for a second reason – the economy. In order to have a booming stock market, you need a booming economy. Earnings need to go up. That justifies higher prices. It also contributes to the positive mood among investors that persuades them that things are getting better and better…and that stocks deserve not only higher prices corresponding with their higher earnings, but also higher P/E multiples. That was the kind of mood that sent the Dow up from under 1,000 in August 1982 to over 14,000 twenty-nine years later.

The market is headed south (chances are it will declare itself as early as next week), yet our neighbours decided to pull up their veggie patch and plant flowering bulbs – good times are back again, after all. So we sat back and wondered, why are people such fools? Why do people sit, day after day, watching the television (or reading the tabloid newspaper), taking it all in, reciting it like it’s some kind of deep, irrefutable truth? Why don’t people think any more?

Well the fact is, most people never really did any thinking. Humanity, on the whole, has always outsourced its thinking, more or less. It has to, because the human intellect is not really capable of processing all of the information all at once and getting it anywhere near right. This is a strong point of Christianity. It gives a template for life which, applied properly and widely enough, leads a society to flourish in every respect. The proof of this is everywhere.

So it brought a chuckle and a smile to read in the Telegraph of a bit of new, kitschy research that reveals how “Men lose their minds speaking to pretty women“. But it’s worth remembering something about what Western Civilisation has become – an ordered, scientifically tested and heavily manipulated social system. It’s plainly obvious how much sex is being used in the media, more and more, to manipulate the mindsets of both men and women, and even boys and girls. There is a general massaging of minds to doubt and disregard the ages old principle of heterosexual monogamy, of the obvious advantages of family unity, and so forth.

The biggest predator of the innocence of children is television and radio. And now, of course, the Internet. People instantly think of a dirty old man with his greasy nose against the monitor, trying to talk his way into the pants of an under-aged schoolgirl, but this is a problem that pre-dates electricity. It’s not the Internet’s fault. The real danger is the recording and advertising industries, with their psychologists, sociologists, artists, and marketing gurus, designing material intended to fleece the unassuming of their money, morality, spirituality, their freedom and even their lives.

As it is with the poisoning of relationships, where people are misled by false ideals and moral relativism through psychology and deception, so it is with money. People are led to believe that there is such a thing as a free market, universally fair accounting, and so on. They forget that Some People Are Created More Equal Than Others. Commentators on the economy always fall back to the same erroneous assumptions which perpetuate the problem, namely that some how Government policy is directed towards the interests of its people, or that market movements are a result of “sentiment” (whereas they are now almost entirely computer generated, driven by word searches on media reports). On the contrary, more than ever, it is the whistle blower who can provide the real information on where things are headed.

It’s like this. Since the majority of traded share volume is electronic and driven by supercomputers, basing their decisions on split-second price movements and news reports coming out of Reuters and other mainstream agencies, an inevitable predictability develops in market movements, because even a clever computer is predictable. Editors of news articles can now influence stock prices by the mere wording they use, and owners of media conglomerates can flood the news with fear stories, and the market jumps (even though no human being jumped). So it’s no surprise that researchers have noticed patterns revealing the hidden hand behind the stocks. There are algorithms which now reasonably predict stock market crashes. But this electronic milking machinery is counterbalanced by the ongoing human factors of insider deals and trading, which compounds the futility of a slow-coach, honest human being trying to win in the greatest casino of all time – the Stock Market. “You can only win if you know the agenda behind the agenda behind the agenda”, is what we overheard in a busy coffee-shop once. It’s rung true ever since.

We found one more article this week that was noteworthy. Eric Hommelberg at goldseek.com suspects that gold prices are about to go through the roof:

The simple truth is that GATA has done such tremendous research and has come up with so much evidence that even some major banks like Credit Agricole and CITI Group have published bullish reports on gold projecting $2000+ gold based on GATA’s findings. As John Embry of Sprott Asset Management once said, everyone with a IQ higher than a grapefruit should admit GATA has a point. Obviously GFMS Chairman Philip Klapwijk fails to meet Embry’s IQ criteria since he refuses to debate GATA on grounds you shouldn’t deal with terrorists.

The reason I quote his article is because he smells a rat. Gold prices are heavily manipulated, a point that is now well and truly proven. Gold is not a money generating asset in and of itself, but a purely speculative item. It need not be avoided like the Plague, but it ought to be treated with the same respect and caution as a vial of Plague. It’s a morally neutral metal which is there to be understood and taken advantage of, should there be any advantage to be taken. Eric puts it like this:

A decrease in gold demand is simply a myth being kept alive by desperate gold bears sitting on huge short positions that can’t be covered at current price levels.

…

The whole system [of US money] is based upon faith and backed by nothing. A skyrocketing gold price would set off all kinds of alarm bells which could lead to a dollar collapse. This is the one and only reason central banks have been dumping gold (through sales and leasing) into the market for so long.

The US can’t reveal its strong dollar policy without undermining its own credibility. Admitting they have been suppressing the gold price for so long would have had devastating consequences for the US dollar. Therefore at all costs, gold policies must be kept secret for the public.

GATA has long argued that gold has been oversold by banks, and that they are likely short of it (stated inventories overstate real inventories). The article might well be on the money. Gold looks set to skyrocket within days, as the stock market looks set to crash at about the same time. Might the US dollar collapse also? Food for thought, and perhaps it’s worth a quick lottery ticket (in the form of a lump of gold, that is).

Well, back to the point of our own article: Principles.

The principles we follow are those of monogamy, family, avoidance of debt and the respect for real work and genuine merit, and a distrust of all things bankish. If the government is stupid enough to throw free money at you, take it and shove it up the bank’s anatomical equivalent of a backside by paying off your debts. If the media tells you to dump your kids in a creche, look after them at home instead. If they say you should buy a flat panel screen, go and sell your old TV and go to a second hand bookshop and buy a classic, like something by Mark Twain or G.K. Chesterton, and shove the rest of the spare cash up the bank’s backside. If the government says put all your spare money away into your superannuation fund, don’t, and once again shove it up the bank’s backside. And so on. If, at the end of it all, the backside is full, use the money to build real wealth for yourself.

The recipe for success in this era is to hold to old, proven principles, despite every message to the contrary. Reduce the difficulty of doing so by not permitting the media to bombard you with uninvited propaganda. Pick and choose your own reading, and clear your mind.

Rioting in America?

Today we have a little daydream about what might happen in American society if unemployment were to skyrocket, as it appears very likely to do.

The scenario might go something like this. Official unemployment soars to twenty, may be thirty percent, such that the number of idle males of working age in America is one in three or one in two. They have no money, their children are hungry, their wives are bitter and angry. There is no point staying at home, so the men walk the streets looking for work, looking for food and looking for trouble. The police find themselves becoming busier and busier picking up loiterers and shoplifters or busting swap meets selling black market goods. Everybody is a criminal nowadays, the police say among themselves. Many of these unemployed men have never stolen anything before and did not anticipate the sophistication of modern shop security systems, nor the heavy handedness of some elements of the police force. Scuffles have been breaking out here and there with angry shoppers or at long queues at soup kitchens, but it’s all orderly 30’s Depression style stuff so far.

One day some inner city police come across a disheveled looking man in his thirties, catch him for jay-walking or some other minor offence (he “looks” suspicious). To teach a quick lesson, they ‘taser’ him in broad daylight, in front of a half dozen nuns on their way to a prayer meeting. The event gets filmed by a teenager with a stolen handy-cam. The man resists and is zapped again, then kicked, and so on. The nuns look on in horror and fear. A police officer sees the teenager filming and confronts the kid, who flees. The kid gets caught and beaten, a short distance up the road. One policeman gets a flower pot thrown on his head by a woman looking down from her apartment above. The nuns rush to the policeman’s aid. Reinforcements arrive in the form of riot police. The nuns are mistaken for having assaulted the police officer (who can’t remember anything) and are arrested and beaten. Every one in sight is rounded up and driven off to detention. Two of the six nuns die en route from heart attacks, since they are in their late eighties. None of this appears in any newspaper or any news network for some days, as is the new policy of media outlets “in the interests of public peace and fairness”.

Almost the same thing happened a week before, but no one heard about it because there was no captured footage. There are only rumours. On this occasion, however, a police clerk handling the evidence happens to be related to one of the deceased nuns and leaks the confiscated video footage, in high definition, on Youtube. People instantly recognize the disheveled looking man as the local guy who runs the soup kitchen network (affectionally known as “Stan The Soup Man”). The local Catholic bishop expresses his outrage at the death of two nuns. Everybody in the city takes to the streets demanding the release of Stan The Soup Man, including the mayor and the bishop. It’s all peaceful, albeit noisy. Most of the people in the crowd have come as families of the unemployed men; wives, children, babies, pet dogs.

They march to police headquarters, demanding an explanation. The police chief is there, on the top step, about to give an announcement of apology and an explanation of events, hoping to assure the crowd that Stan The Soup Man is okay and was merely detained for questioning over an unrelated matter. Just in case, riot police are assembled out of view, a couple of streets away. They are told by their superior officer that “it’s nuttin’ much, just a bunch of women and kids”. However, during his speech, unbenknownst to the police chief, Stan The Soup Man now lay unconscious in a prison cell, bleeding into his head. He was fine several minutes ago, but Stan was always very sensitive about his Hispanic roots, and one police guard had just made a racist taunt agains him. Stan couldn’t hold back and said something in return. A beating ensues, and now Stan was minutes away from inevitable death. At the closing words of the police chief’s speech, an SMS message is received from within the police compound that Stan had just died. Chaos and a blood bath ensues. Women and children are shot and killed. Within hours, protests, sit ins, and riots across the country break out.

It’s not difficult for such an even to happen. Similar mistakes are made by the police, probably every few minutes, but like stray sparks of an electric motor, they mean nothing unless the surrounding conditions are such that an explosion results. Looking at the various developments in the US economy currently, with nationalization of the remnants of US manufacturing, the loss of over 400,000 jobs per month around the country and the increasing aggressiveness, both politically and economically, of America’s biggest trading partner, China, it is very likely that an explosive social situation will develop soon.

There is nothing, currently, to prevent the coming dip in living standards headed for the United States. That said, there is a long way for those standards to fall before one could consider America ‘poor’. The task for government lies in preventing poverty to turn to hunger and starvation. It is when the most basic needs of people are not met that civil disorder becomes most likely.

Will the Obama administration find within itself the skills and wisdom to carry out the successful rescue of the coming wave of an American Underclass? This is not likely, given how poorly eveyrthing else has been managed. The White House itself appears directionless and desperate. All they have is contingency plans, but no way forward, despite all the rhetoric to the contrary. It’s also not realistic to see an atheist, materialistic regime embarking on any kind of genuine charitable enterprise. To US Government policy makers, people are not souls, but numbers and statistics. They are a resource to be managed and exploited. The War on Drugs is the clearest example of how decisions are made in America, where two thirds of the prison population are there because of drug related crimes.

The likely path to be taken by America is to boost its military. It will come in the mass recruitment of the unemployed in exchange for food stamps, housing assistance and health insurance. If there are no wars to fight, the soldiers can be let loose on America’s streets to “help” the police, or to clean the streets, or do some other brain-numbing task. This may be the lesser of two evils, and would likely be sold to the public as such, but it can only result in the further brutalisation and dehumanisaiton of American society.

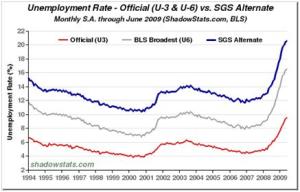

Prepare for the Big Dipper

A report on MSN news estimates US unemployment at 20%, citing inaccuracies and bias in data collection and methods of calculating the unemployment rate in America. Ah, America, the nation where Freedom of Speech really means freedom of the rich to tell lies with impunity. It’s the nation drunk on ignorance, the land of make-believe, where Michael Jackson with his Neverland and Disney with his Disneyland were quite at home and nothing out of the ordinary.

Any reports about economic developments, positive or negative, coming out of mainstream U.S. media, need to be taken with a grain of salt. However, when you get an official unemployment rate at just under 10% (which people think is already staggeringly high), and an expert opinion claiming it is more like 20%, it’s worth a second thought. There certainly has been an ongoing trend of absolute bollocks posing as news over the past few years. The Iraq War was going to be a rip-roaring success, with soldiers greeted by cute Iraqi children in folk dress, with tears of joy, laying flowers at the curbside as American tanks rolled in. It was supposed to usher in a “new Springtime” for the US economy and peace in the Middle East. The Lehman Bros. company collapse was going to be isolated, easily patched up. The world would chuckle and move on. That is, according to all the major newspapers and news networks. Many people suspected, however, that it was complete rubbish. They were dead right.

What can be predicted from a society that lies to itself to the extent that occurs in America is the same as could be predicted of a con man. People believe him at first, but after a while the trail of destruction becomes a little too obvious, the cons too ambitious, and suddenly a few intelligent people take the time to do a bit of background reading. Soon enough, the con man is busted and the game is up.

This brings us to another issue: expiring unemployment benefits. Continuing unemployment claims fell 53,000 to 6.7 million last week, but Deutsche Bank’s chief U.S. economist Joseph LaVorgna wonders how much of this decline is due people exhausting their standard 26-week benefit. He says: “We are concerned about what will happen when a significant share of out-of-work individuals’ benefits completely expire, because this could lead consumer spending to re-weaken, hence jeopardizing a fragile recovery.”

It’s likely that unemployment is massively understated in America, as it is in most countries. No politician likes to boast about the figures, and aspiring politicians are cautious to doubt them, lest they themselves get elected and are forced to revise the figures upwards.

The usefulness of this information lies in avoiding bad investments in the short term (like shares or apartments), and planning for one’s own unemployment. A 1 in 5 figure means that any safety nets in place are likely to be already strained to breaking point. If the figure advances to 2 in 5, then the term “safety net” is not even worth remembering. At this stage, people ought to stop believing newspapers and be well on their way to preparing to hunker down for a long, cold economic winter. Survival is the name of the game now.

Industries likely to ride out the difficult times are those that provide essential services, support military infrastructure or produce food. However, for America, new opportunities are going to appear when, finally, the U.S. dollar collapses. Local manufacturing will suddenly become a good idea, but at the expense of working conditions. Belonging to the military will suddenly become an obviously bad idea. What exists now in Mexico is prehaps a foretaste of things to come for those who are North of the Border. Who knows, there may not even be a border anymore.

Rephrasing Bloomberg

Men In Suits

Articles on Bloomberg are entertaining, juicy, and just a tad biased. That’s what makes Bloomberg a much better read than most news outlets (since the news is additionally entertaining and juicy).

In a recent article with the understated and rather misleading title “Goldman Sach’s Investment in Trading Code Put at Risk by Theft”, a computer geek employed at the company is accused of running off with a vital piece of company software, it is quoted:

Aleynikov transferred the code, which is worth millions of dollars, to a computer server in Germany, and others may have had access to it, Facciponti said, adding that New York-based Goldman Sachs may be harmed if the software is disseminated.

The man was travelling. Anyone who knows about travel in the United States understands that one must not, under any circumstances, carry any information on a hard drive that could be worth something to anyone. So it is standard practice to transfer one’s information (including any projects one might be working on) in a secure manner to the Internet, like a VPN, and securely wiping the hard drive prior to leaving for the airport.

But the comment that makes one laugh comes from the prosecution:

The prosecutor added, “Once it is out there, anybody will be able to use this, and their market share will be adversely affected.”

The proprietary code lets the firm do “sophisticated, high-speed and high-volume trades on various stock and commodities markets,” prosecutors said in court papers. The trades generate “many millions of dollars” each year.

In other words, the software allows Goldman Sachs to, basically, cheat. And if the software was released, it would let everybody, well, cheat. And that would not be fair, because it goes against the whole principle of, err, cheating. That is, if everybody cheats the same way, then it ceases to be cheating.

The defense attorney is also quoted:

“If Goldman Sachs cannot possibly protect this kind of proprietary information that the government wants you to think is worth the entire United States market, one has to question how they plan to accommodate every other breach,” she said.

The defense is right of course, but it’s not that the government has any more dignity to lose. Many know very well how Wall Street operates and how the government helps, but not everybody believes it yet.

Perhaps George H.W. Bush’s infamous 2006 quotation will some day come true:

“if the American people knew what we have done, they would string us up from the lamp posts.”

Perhaps the real worry for Goldman Sachs is that the leakage of such sensitive software would reveal just how the markets are rigged by the big players, and how the honest majority is swindled at every turn.

Every Download Is Sacred

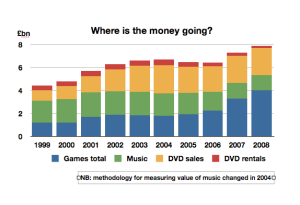

An excellent blog post appeared in the Guardian newspaper entitled “Are Downloads Really Killing Music? Or Is It Something Else?“, where it was stated:

But the reality is that nowadays, one can choose between a game costing £40 that will last weeks, or a £10 CD with two great tracks and eight dud ones. I think a lot of people are choosing the game – and downloading the two tracks. That’s real discretion in spending. It’s hurting the music industry, sure. But let’s not cloud the argument with false claims about downloads.

The change in culture away from music has to do with technology and a fall in the quality in musical production.

The advantage of progams like Amarok, iTunes and other music collection software is that you can rate your songs and delete the rubbish that you would otherwise have to get out of your sofa and skip. You can set music for your mood, or the time of day, or the kinds of people who happen to be visiting. Also, you can easily share your stuff. It’s just so easy to stick a CD in the drive and soak up the tracks in lossless quality and pass them on. Music has become cheap, like the framed posters you can get at the two-dollar shop.

When the printing press was invented, the cost of obtaining a book plummeted (probably by a hundred times), since it no longer needed to be written by hand. When the Internet reached prevalence, the underlying cost of producing the electronic form of a novel plummeted (easily by a hundred times). You want someone to make an illuminated manuscript of the Harry Potter series? It’ll cost you many thousands, if you can find someone who can do it. The corollary is that since text is so easy to publish now, there’s an awful lot of cheap rubbish about (you’re reading it, for example). It’s no longer worth paying for, yet a lot of it is very good.

The same is for music. Most of it now is electronic. No one has to be able to sing in tune, voices are modulated and modified and forced so that they fit the rhythm and melody which itself was constructed in an electronic composing suite. A lot of music has no live instruments whatsoever. The creative quality of most of the music that is produced by the major record labels has a low creative quality. Mediocrity abounds. It’s not worth paying for.

Everybody can see that the nature of the music business is changing, but still the recording industry cannot come to terms with this fact. Instead, it keeps churning out the same garbage and expects people to pay top dollar for twenty cents-worth of plastic. People are better off buying a blank CD and putting something worthwhile on it.

In the future, music will arise from a community of enthusiasts and will be, largely, free. The best musicians and the best productions will be commissioned now and again to create works for a particular piece of entertainment, like a film or software. There will still be live performers, and if anything, this will be the mainstay of music. The recording companies ought to accept this and move on.