Archive

Without cash, gold can have no monetary role

Cashless Beast

Although the topics of the Cashless Society and the Gold Monetary Standard have been discussed previously on this and other sites, we feel that further discussion on these pressing issues is warranted.

The Cashless Society

Earlier we speculated that there might be a glorious return to sound money, such as a precious metal standard. But you can forget about gold as a real standard to moderate the issue of money. Not because it’s not a good idea. A gold standard is a fantastic idea, but it will not come about, because the finance industry has something else in mind. We all know it’s coming, but it has been somewhat forgotten as a discussion point. Yes, we mean the Cashless Society. Every monetary transaction is moving to electronic form.

Back in 2007, credit card Visa chief Peter Ayliffe predicted that a cashless society (in the UK) would come into being by 2012. It may not seem like a sure thing, but the timing of such a prediction is worth making a note of. The problems of electronic transactions at the moment are that financial institutions are making too much money from surcharges and fees, keeping cash as a more attractive way to buy small to medium priced products than plastic. During the current artificially created economic crisis, there has been a contraction of credit, but the idea of eliminating cash is still high on the agenda, even at the UN. The impediments to a universal cashless system can be removed overnight: remove fees on electronic transactions, and impose unreasonable fees on obtaining or depositing cash. Within a couple of years the system will be locked in, and nobody will take cash any more.

Introduced as part of the national e-Governance initiative, the e-Purse, embedded on national ID and resident cards, is the first of its kind in the region. Implemented by the Royal Oman Police (ROP), in association with the Information Technology Authority (ITA) and BankMuscat, the national e-Purse project will revolutionise cash transactions.

…

“Being an identity card, the e-Purse always remains with citizens and residents. Whenever e-Purse is used, the identity of the user is verified and the government can track each transaction. The support from ITA to the e-Purse project is in line with the directive of His Majesty Sultan Qaboos bin Said to enhance e-government services in Oman,” [Dr Salim Al Ruzaiqi, chief executive officer, ITA] added.

The cashless society is a government’s dream. Tax evasion becomes practically impossible, resulting in substantial gains in tax revenue. In theory, the purchase of dangerous substances and weapons becomes more easily traceable to individuals, making criminal activity increasingly difficult. Except for bartering, which is difficult to conduct on a large scale, the economy becomes completely accountable. Not a cent is lost, and society becomes unable to avoid policy changes. No more armoured cars, bank robberies, muggings, bribes, illegal drugs, and so on. All of this has been claimed by proponents of the cashless society. They tend not to mention certain other obvious points which might coincide with this phenomenon, such as the storage of personal information together with the electronic money devices (be they cards or some other form of identification), such as medial information, license details and biometric data. They are already being introduced.

The cashless society would likely accompany the introduction of a single world currency. Without the need to exchange physical coins or notes, all money becomes completely arbitrary. All money would reside on computer accounts, can be given any unit value, and can be created or destroyed at will (unlimited credit). Potentially, all money could reside on a single supercomputer, to save energy.

Banks are especially poised to benefit:

“Banks are very excited about replacing cash. Smart Cards give them the opportunity to make some big bucks off interest-free loans from their customers. Once a customer transfers credit to a cash card, the bank can stop paying interest but gets to hold on to the cash until it’s billed by a merchant. If 100 million people used a card with an average of only 10 unspent dollars on it, the banks would reap $1 billion a day of interest-free money to invest.” (Forbes Magazine, 1998)

Then of course is the argument for the implantation of microchips, or some other physical and permanent means of identification. The technology is indeed ready and has reached a mature status. It is only society that is not yet ready.

The truth of the matter is, of course, different. Many of the arguments in favour of the cashless society are false, where the truth in many cases is diametrically opposed to what is claimed. So what problems might exist with the Utopian dream of universal electronic funds transfer?

Most of the logistic problems are covered elsewhere, and can be easily thought about. Aside from the fact that private transfer of money becomes impossible without the involvement of the universal infrastructure, the other problems are identical to those that plague electronic money transfers already. Identity theft is the biggest problem, and it continues to occur as computing systems become ever complex and bug-ridden.

From our point of view there are three major threats to ordinary people arising from a cashless monetary system. Some of these can already be appreciated, if you just imagine your life suddenly without any access to your credit or bank cards.

(Out of) Control

Could it be said that the quality of governance is directly proportional to the likelihood that the governor is deposed should he or she fail to perform? The easier it is to block the government, the better.

The motivations for a cashless society are really those of making the government of the population easier (for government) and not to ‘enable’ or ’empower’ ordinary people. Supposedly, it would cost less to collect taxes, to police fraud, to run after escapees, because all you need to do is look up the individual’s number and instantly you can see practically every interaction the person has had, each hour of each day. Tracking the movements of people becomes a trivial matter. It’s no secret that even the rudimentary magnetic strips on credit cards can be read from a distance, particularly at doorways if the appropriate magnetic coils are installed (which, in most first world retail stores, they are).

Any electronic device designed to act as a portable electronic wallet will also serve as an access key and unique identifier. It is merely natural progression to bundle passport, wallet, driver’s license, medical alerts and personal details into one key, which is synchronized both locally (on the person) and centrally (on the supercomputer). The same can be rigged to allow key-less entry to house, car, workplace, and airport departure gate. The benefits are a seamless, keyless, paperless, and no-touch life from the apartment door, to the secure car-park, into the car, into work, through the shops, to one’s overseas holiday, and all the purchases and movements there, and back. All of this can be achieved with a single microchip, either as a card, embedded in a wristwatch, or implanted under the skin.

The great weakness of a centralized, integrated and unified key system is that people can be ‘unplugged’ instantaneously and effortlessly, even arbitrarily. Physical papers, a wad of cash and a set of metal keys is a robust, low-tech and redundant way of doing things, yet the tiny gains in convenience of electronic keys (and money) come at great personal risk, because the power is completely out of the hands of the individual. Any failure of the supporting infrastructure is a total failure. It can happen at the hands of a disgruntled or corrupt employee, a hacker or an out-of-control government. The temptation to abuse such a system is immeasurable. If it can happen, it will happen.

In essence, by “holding” all of an individual’s money for him, the electronic monetary system robs the individual of all of his power. This is the ultimate form of population control. In particular, since populations now live in cities and are totally dependent on common infrastructure for their survival, the cashless society permits any kind of political and social change to be effected with no way for people to resist effectively, nor to organize against the system without being found out at a very early stage. The cashless society has the potential to transform what today appears to be a free society into a prison that is tighter and more oppressive than has existed in any totalitarian system in the past, including the Soviet Union under Stalin.

Black Box Economy

It is already problematic that the vast majority of money that is “out there” exists in the form of electrons on magnetic and solid state devices, and not as tangible wealth. We read in the news about billions of dollars being “wiped off” stock markets, and trillions of dollars sitting “on the sidelines”. All of it is meaningless sensationalism, and only illustrates the absurdity of fiat money. The fact that central banks can magic trillions of dollars of new funds into the economy in the space of a few seconds, and that the supply of credit is limited only by people’s willingness to borrow, means that the number that represents your life savings can be wiped out in seconds, by the sudden dilution of the global money supply (to name but one example). The fact that company shares are mostly traded by computers, with the value of shares fluctuating every millisecond as a result of computer algorithms and not human decision making, makes the whole business of market investment a farce.

There is no way of being certain, in an electronic economy, that anything is real. There is not necessarily any paper trail to account for the volume of transactions that exists, and a corrupt elite (which, conveniently enough, already exists) can line its pockets with limitless money, with no way of detecting or proving the crime. Forensic information can be planted or removed all too easily. Without cash, there is no way for an individual to opt out of the system by holding his money in physical form. In a cashless society, there remains only one certainty: hard assets. Everything else will have made the full transition to becoming make-believe.

In many ways, the electronic economy reflects the modern approach to morals. There is great emphasis on civics, and on the conduct of individuals in public (looking good in public), but there is no emphasis on personal moral integrity and the proper conduct of thoughts and deeds in one’s private realm. Modern society encourages personal moral depravity, and teaches a perfect hypocrisy, whereby people in public behave impeccably, yet frequently their private lives are as corrupt and vile as can be imagined. An electronic economy looks squeaky clean on the outside, but there is no telling what manipulation, corruption and wholesale theft is going on beneath. There is also no way to trust the individuals maintaining and governing the monetary infrastructure, since they are as likely to be soulless, amoral and opportunistic as society itself has become.

The Apocalyptic Vision

It is easy to laugh at religious zealots when they harp on about St. John’s Apocalypse, on things such as the Mark of the Beast, and so on. In their rush to sell a message they don’t understand, they undermine the value of the Sacred Texts, leading others to miss out on the wisdom contained therein. We quote the passage that appears to be relevant to the idea of the cashless society:

And he shall make all, both little and great, rich and poor, freemen and bondmen, to have a character in their right hand, or on their foreheads. 17 And that no man might buy or sell, but he that hath the character, or the name of the beast, or the number of his name. Here is wisdom. He that hath understanding, let him count the number of the beast. For it is the number of a man: and the number of him is six hundred sixty-six.

These dramatic passages are full of symbolism and, to some extent, allegory. Throughout the last two millennia, people have tried to torture the words to fit the situation of the day. The lesson we draw from the passage is that the restriction to trade, imposed on individuals because of a religious or political attribute, is always a bad thing. The point to be taken from the Apocalypse, however, is that the predictions apply to the entire world, not just the situation in one or another country at a given time. The point of our article, in part, is that the cashless society is a phenomenon which is capable of being imposed globally, perhaps over the space of a decade or so.

If the G20, for example, met for another “crisis meeting”, and decided, once and for all, to coalesce their currencies, they may simultaneously claim that it is cheaper not to issue any notes or coins, but to issue electronic keys, as described above. Once some heavyweight economies adopt the idea, all else will follow, or face the sword. The scenario is plausible, even though in 2009 it still seems like a pipe dream.

It ought to be noted that think tanks that guide global policy have attitudes which resemble those described by St. John.

In the closing plenary session of the [San Francisco, 1996] forum, philosopher/author Sam Keen provided a summary and conclusive remarks on the conference. Among the conference participants, said Keen, “there was very strong agreement that religious institutions have to take primary responsibility for the population explosion. We must speak far more clearly about sexuality, about contraception, about abortion, about the values that control the population, because the ecological crisis, in short, is the population crisis.

Cut the population by 90 percent and there aren’t enough people left to do a great deal of ecological damage.”

It’s had to imagine just how so many people could be killed without leaving the planet itself uninhabitable, but there is no limit to human ingenuity. There is also, clearly, an insanity at work that makes Nero look like a dull boy.

Gold Has No Place

To go back to material matters, we think once again of gold. Even if a single world currency is purportedly based on a precious metal, because this currency is likely to be cashless, the metallic standard is nothing more than an empty promise. You are trusting the same men in the same suits who are this very day swindling the planet without rest. Just as there is no living soul within the body of the modern man (in a suit), there can be no golden heart to an electronic currency.

We conclude that whatever actions can be taken to limit the progression towards the elimination of cash, should be taken. More importantly, however, it behoves every person to consider the implications of such a system coming about, and to have contingencies in place (a topic in its own right).

Haven’t Heard of Chesterton?

Gilbert Keith Chesterton - 1874-1936

The problems of the modern world do not merely revolve around whether money is based on faith, or gold, or seashells, nor whether the US has the weapons, or Russia, or China. All the problems persist, while wrong ideas persist. So it is our pleasure to add a link to our site in promotion of Chesterton.org. As the name suggests, it contains the collected works of what was arguably the greatest author of the 20th century. To that end, we quote from the website, with our emphasis in bold:

Chesterton is the most unjustly neglected writer of our time. Perhaps it is proof that education is too important to be left to educators and that publishing is too important to be left to publishers, but there is no excuse why Chesterton is no longer taught in our schools and why his writing is not more widely reprinted and especially included in college anthologies. Well, there is an excuse. It seems that Chesterton is tough to pigeonhole, and if a writer cannot be quickly consigned to a category, or to one-word description, he risks falling through the cracks. Even if he weighs three hundred pounds.

But there is another problem. Modern thinkers and commentators and critics have found it much more convenient to ignore Chesterton rather than to engage him in an argument, because to argue with Chesterton is to lose.

Chesterton argued eloquently against all the trends that eventually took over the 20th century: materialism, scientific determinism, moral relativism, and spineless agnosticism. He also argued against both socialism and capitalism and showed why they have both been the enemies of freedom and justice in modern society.

And what did he argue for? What was it he defended? He defended “the common man” and common sense. He defended the poor. He defended the family. He defended beauty. And he defended Christianity and the Catholic Faith. These don’t play well in the classroom, in the media, or in the public arena. And that is probably why he is neglected. The modern world prefers writers who are snobs, who have exotic and bizarre ideas, who glorify decadence, who scoff at Christianity, who deny the dignity of the poor, and who think freedom means no responsibility.

We think it ought to be part of every educated person’s task to be familiar with Gilbert Keith Chesterton, his writings, his thinking and his witty humour. It is becoming ever more important to promote clear, critical thinking in the face of our increasingly murky world of vague ideas adrift in a sea of insanity.

Don’t Get Drunk at This Party

The Bank

Several rather unconnected reports give a poignant lesson on the importance of true principles. That is, if you follow a correct idea through to its conclusion, it does not matter what the established facts may be at a given time, your hunch will come good.

In a not unexpected report (Financial Times), it’s announced that the G20 Summit is set to deliver a coordinated removal of the various stimulus packages that have, for the past year or so, “rescued” our economy from the “the Abyss“, as our beloved Rudd called it.

Jean-Claude Trichet, European Central Bank president, writing in Friday’s Financial Times, has outlined for the first time the principles the ECB would use to unwind the exceptional steps it has taken.

..

The OECD is forecasting that in 2009, the contraction in output among G7 nations will be 3.7 per cent, less severe than the 4.1 per cent decline forecast just a few months ago. The OECD downgraded the outlook for the UK, which will be the only G7 nation not to show growth in any single quarter of 2009.

The idea still holds true that, had there not been any stimulus packages, and had the market been allowed to take its natural course (as a side effect of an untenable and unnatural way of doing things over the past several decades), then we would have reached the bottom sooner. Arguably, more villains would have been caught off guard and not given the precious time they’ve now gotten to re-manoeuvre themselves before the safety net is removed. And the idea of saving the Government splurge money instead of spending it has once and for all proven correct. It was never going to last anyway.

Still, it’s frightening to see such unison in global economic policy. The more this happens, the more you can be assured that Democracy is dead. They have decided that, through their artificial economic “stimulus”, they have convinced enough rabbits that the sky was not really falling in. The cute little bunnies have come out of their warrens, raising their furry ears once more. They are ready once again for the slaughter, and the big slaughter machine (the Stock Market) has had its blades resharpened.

The voice of experience and wisdom is well heard in Bill Bonner’s latest Daily Reckoning article, where he says that the market (and the economy) never reached its true bottom:

We say that because stocks never went low enough to qualify for a genuine bottom…and investors never showed the kind of disgust that you usually get at real bottoms.

We say that, too, for a second reason – the economy. In order to have a booming stock market, you need a booming economy. Earnings need to go up. That justifies higher prices. It also contributes to the positive mood among investors that persuades them that things are getting better and better…and that stocks deserve not only higher prices corresponding with their higher earnings, but also higher P/E multiples. That was the kind of mood that sent the Dow up from under 1,000 in August 1982 to over 14,000 twenty-nine years later.

The market is headed south (chances are it will declare itself as early as next week), yet our neighbours decided to pull up their veggie patch and plant flowering bulbs – good times are back again, after all. So we sat back and wondered, why are people such fools? Why do people sit, day after day, watching the television (or reading the tabloid newspaper), taking it all in, reciting it like it’s some kind of deep, irrefutable truth? Why don’t people think any more?

Well the fact is, most people never really did any thinking. Humanity, on the whole, has always outsourced its thinking, more or less. It has to, because the human intellect is not really capable of processing all of the information all at once and getting it anywhere near right. This is a strong point of Christianity. It gives a template for life which, applied properly and widely enough, leads a society to flourish in every respect. The proof of this is everywhere.

So it brought a chuckle and a smile to read in the Telegraph of a bit of new, kitschy research that reveals how “Men lose their minds speaking to pretty women“. But it’s worth remembering something about what Western Civilisation has become – an ordered, scientifically tested and heavily manipulated social system. It’s plainly obvious how much sex is being used in the media, more and more, to manipulate the mindsets of both men and women, and even boys and girls. There is a general massaging of minds to doubt and disregard the ages old principle of heterosexual monogamy, of the obvious advantages of family unity, and so forth.

The biggest predator of the innocence of children is television and radio. And now, of course, the Internet. People instantly think of a dirty old man with his greasy nose against the monitor, trying to talk his way into the pants of an under-aged schoolgirl, but this is a problem that pre-dates electricity. It’s not the Internet’s fault. The real danger is the recording and advertising industries, with their psychologists, sociologists, artists, and marketing gurus, designing material intended to fleece the unassuming of their money, morality, spirituality, their freedom and even their lives.

As it is with the poisoning of relationships, where people are misled by false ideals and moral relativism through psychology and deception, so it is with money. People are led to believe that there is such a thing as a free market, universally fair accounting, and so on. They forget that Some People Are Created More Equal Than Others. Commentators on the economy always fall back to the same erroneous assumptions which perpetuate the problem, namely that some how Government policy is directed towards the interests of its people, or that market movements are a result of “sentiment” (whereas they are now almost entirely computer generated, driven by word searches on media reports). On the contrary, more than ever, it is the whistle blower who can provide the real information on where things are headed.

It’s like this. Since the majority of traded share volume is electronic and driven by supercomputers, basing their decisions on split-second price movements and news reports coming out of Reuters and other mainstream agencies, an inevitable predictability develops in market movements, because even a clever computer is predictable. Editors of news articles can now influence stock prices by the mere wording they use, and owners of media conglomerates can flood the news with fear stories, and the market jumps (even though no human being jumped). So it’s no surprise that researchers have noticed patterns revealing the hidden hand behind the stocks. There are algorithms which now reasonably predict stock market crashes. But this electronic milking machinery is counterbalanced by the ongoing human factors of insider deals and trading, which compounds the futility of a slow-coach, honest human being trying to win in the greatest casino of all time – the Stock Market. “You can only win if you know the agenda behind the agenda behind the agenda”, is what we overheard in a busy coffee-shop once. It’s rung true ever since.

We found one more article this week that was noteworthy. Eric Hommelberg at goldseek.com suspects that gold prices are about to go through the roof:

The simple truth is that GATA has done such tremendous research and has come up with so much evidence that even some major banks like Credit Agricole and CITI Group have published bullish reports on gold projecting $2000+ gold based on GATA’s findings. As John Embry of Sprott Asset Management once said, everyone with a IQ higher than a grapefruit should admit GATA has a point. Obviously GFMS Chairman Philip Klapwijk fails to meet Embry’s IQ criteria since he refuses to debate GATA on grounds you shouldn’t deal with terrorists.

The reason I quote his article is because he smells a rat. Gold prices are heavily manipulated, a point that is now well and truly proven. Gold is not a money generating asset in and of itself, but a purely speculative item. It need not be avoided like the Plague, but it ought to be treated with the same respect and caution as a vial of Plague. It’s a morally neutral metal which is there to be understood and taken advantage of, should there be any advantage to be taken. Eric puts it like this:

A decrease in gold demand is simply a myth being kept alive by desperate gold bears sitting on huge short positions that can’t be covered at current price levels.

…

The whole system [of US money] is based upon faith and backed by nothing. A skyrocketing gold price would set off all kinds of alarm bells which could lead to a dollar collapse. This is the one and only reason central banks have been dumping gold (through sales and leasing) into the market for so long.

The US can’t reveal its strong dollar policy without undermining its own credibility. Admitting they have been suppressing the gold price for so long would have had devastating consequences for the US dollar. Therefore at all costs, gold policies must be kept secret for the public.

GATA has long argued that gold has been oversold by banks, and that they are likely short of it (stated inventories overstate real inventories). The article might well be on the money. Gold looks set to skyrocket within days, as the stock market looks set to crash at about the same time. Might the US dollar collapse also? Food for thought, and perhaps it’s worth a quick lottery ticket (in the form of a lump of gold, that is).

Well, back to the point of our own article: Principles.

The principles we follow are those of monogamy, family, avoidance of debt and the respect for real work and genuine merit, and a distrust of all things bankish. If the government is stupid enough to throw free money at you, take it and shove it up the bank’s anatomical equivalent of a backside by paying off your debts. If the media tells you to dump your kids in a creche, look after them at home instead. If they say you should buy a flat panel screen, go and sell your old TV and go to a second hand bookshop and buy a classic, like something by Mark Twain or G.K. Chesterton, and shove the rest of the spare cash up the bank’s backside. If the government says put all your spare money away into your superannuation fund, don’t, and once again shove it up the bank’s backside. And so on. If, at the end of it all, the backside is full, use the money to build real wealth for yourself.

The recipe for success in this era is to hold to old, proven principles, despite every message to the contrary. Reduce the difficulty of doing so by not permitting the media to bombard you with uninvited propaganda. Pick and choose your own reading, and clear your mind.

Rephrasing Bloomberg

Men In Suits

Articles on Bloomberg are entertaining, juicy, and just a tad biased. That’s what makes Bloomberg a much better read than most news outlets (since the news is additionally entertaining and juicy).

In a recent article with the understated and rather misleading title “Goldman Sach’s Investment in Trading Code Put at Risk by Theft”, a computer geek employed at the company is accused of running off with a vital piece of company software, it is quoted:

Aleynikov transferred the code, which is worth millions of dollars, to a computer server in Germany, and others may have had access to it, Facciponti said, adding that New York-based Goldman Sachs may be harmed if the software is disseminated.

The man was travelling. Anyone who knows about travel in the United States understands that one must not, under any circumstances, carry any information on a hard drive that could be worth something to anyone. So it is standard practice to transfer one’s information (including any projects one might be working on) in a secure manner to the Internet, like a VPN, and securely wiping the hard drive prior to leaving for the airport.

But the comment that makes one laugh comes from the prosecution:

The prosecutor added, “Once it is out there, anybody will be able to use this, and their market share will be adversely affected.”

The proprietary code lets the firm do “sophisticated, high-speed and high-volume trades on various stock and commodities markets,” prosecutors said in court papers. The trades generate “many millions of dollars” each year.

In other words, the software allows Goldman Sachs to, basically, cheat. And if the software was released, it would let everybody, well, cheat. And that would not be fair, because it goes against the whole principle of, err, cheating. That is, if everybody cheats the same way, then it ceases to be cheating.

The defense attorney is also quoted:

“If Goldman Sachs cannot possibly protect this kind of proprietary information that the government wants you to think is worth the entire United States market, one has to question how they plan to accommodate every other breach,” she said.

The defense is right of course, but it’s not that the government has any more dignity to lose. Many know very well how Wall Street operates and how the government helps, but not everybody believes it yet.

Perhaps George H.W. Bush’s infamous 2006 quotation will some day come true:

“if the American people knew what we have done, they would string us up from the lamp posts.”

Perhaps the real worry for Goldman Sachs is that the leakage of such sensitive software would reveal just how the markets are rigged by the big players, and how the honest majority is swindled at every turn.

Every Download Is Sacred

An excellent blog post appeared in the Guardian newspaper entitled “Are Downloads Really Killing Music? Or Is It Something Else?“, where it was stated:

But the reality is that nowadays, one can choose between a game costing £40 that will last weeks, or a £10 CD with two great tracks and eight dud ones. I think a lot of people are choosing the game – and downloading the two tracks. That’s real discretion in spending. It’s hurting the music industry, sure. But let’s not cloud the argument with false claims about downloads.

The change in culture away from music has to do with technology and a fall in the quality in musical production.

The advantage of progams like Amarok, iTunes and other music collection software is that you can rate your songs and delete the rubbish that you would otherwise have to get out of your sofa and skip. You can set music for your mood, or the time of day, or the kinds of people who happen to be visiting. Also, you can easily share your stuff. It’s just so easy to stick a CD in the drive and soak up the tracks in lossless quality and pass them on. Music has become cheap, like the framed posters you can get at the two-dollar shop.

When the printing press was invented, the cost of obtaining a book plummeted (probably by a hundred times), since it no longer needed to be written by hand. When the Internet reached prevalence, the underlying cost of producing the electronic form of a novel plummeted (easily by a hundred times). You want someone to make an illuminated manuscript of the Harry Potter series? It’ll cost you many thousands, if you can find someone who can do it. The corollary is that since text is so easy to publish now, there’s an awful lot of cheap rubbish about (you’re reading it, for example). It’s no longer worth paying for, yet a lot of it is very good.

The same is for music. Most of it now is electronic. No one has to be able to sing in tune, voices are modulated and modified and forced so that they fit the rhythm and melody which itself was constructed in an electronic composing suite. A lot of music has no live instruments whatsoever. The creative quality of most of the music that is produced by the major record labels has a low creative quality. Mediocrity abounds. It’s not worth paying for.

Everybody can see that the nature of the music business is changing, but still the recording industry cannot come to terms with this fact. Instead, it keeps churning out the same garbage and expects people to pay top dollar for twenty cents-worth of plastic. People are better off buying a blank CD and putting something worthwhile on it.

In the future, music will arise from a community of enthusiasts and will be, largely, free. The best musicians and the best productions will be commissioned now and again to create works for a particular piece of entertainment, like a film or software. There will still be live performers, and if anything, this will be the mainstay of music. The recording companies ought to accept this and move on.

More CIA Torture

Torture by the US: Not a new phenomenon

In The Australian newspaper is a report on revelations on CIA torture methods employed on “terrorism” suspects. It’s now fairly evident to most that the term “terrorist” is arbitrary and is usually taken to mean anyone who is unliked by a given regime, be it a Western democracy, a Fascist or Communist dictatorship, or whatever other flavor you prefer – sweet, sour, hot or spicy.

…the Justice Department memos released last month indicate the method involved forcing chained prisoners to stand, sometimes for days on end, the report said.

The prisoners had their feet shackled to the floor and their hands cuffed close to their chins the paper claimed.

Detainees were clad only in diapers and not allowed to feed themselves. A prisoner who started to drift off to sleep would tilt over and be caught by his chains, according to the report.

Once again, medical personnel were in attendance to try to prevent permanent injury to the prisoners. That this kind of news is no longer surprising is, in itself, a sign of how bad things have gotten. It’s also a stupid move by the US Government (and the CIA) to keep doing this to detainees. To the ancient Art of War:

Sun Tzu said: The art of war is of vital importance to the State. …The Moral Law causes the people to be in complete accord with their ruler, so that they will follow him regardless of their lives, undismayed by any danger. …

How can the Western world expect to have a victory over any perceived enemy when it reduces itself to the lowest moral level on what seems to be every aspect of social life? It would appear that modern statecraft does not take into account moral superiority over the enemy. That is a grave mistake, perhaps it will even prove to be a fatal one.

While in the short term it might look clever to strike pre-emptively, to grab land without pretext from a weaker foe, to impose one’s own cultural values on the conquered population (however debased and morally bankrupt one’s own culture may be), it is not ultimately sustainable. Each time a wrongful act is performed in this way, our own society is weakened,our people corrupted. With the fall in moral standards with respect to the treatment of the enemy comes the fall in discipline, loyalty and honesty. These are the foundations on which a civilization is built.

Obama’s regime may understand this, but its approach to the matter is not to purge the departments responsible for this moral bankruptcy, but to reclassify, rename, reword and resume the activity.

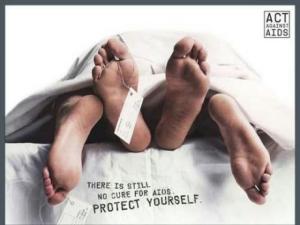

Truth in Paradox – AIDS in Africa

AIDS Patient

The AIDS pandemic in sub-Saharan Africa is said to currently afflict around 22 million people, which is roughly 5% of adults. This value is now lower than was previously quoted, yet it is by no means a sign of an improving situation. There are critics who cite many problems associated with the collection of statistics and their interpretation. Confounding factors such as selection bias (non-random sampling) and elements of corruption on the part of governments in order to obtain foreign aid have been identified. The lower values are probably truer values and show that in the past, the degree to which AIDS has affected Africa has been overstated. It’s still a pandemic. It’s still extremely big, but it means that tracking the progress of AIDS in Africa is proving to be very difficult and gathered information unreliable. It means that any claims to success on the part of the World Health Organization in combating AIDS through the distribution of condoms cannot be easily verified, since we really cannot trust the statistics, especially if the methods of data collection are changing.

It is on this background of unreliable, untrustworthy information on AIDS and HIV prevalence that Pope Benedict XVI and now Cardinal George Pell make claims that, paradoxically, condoms are making matters worse rather than better, through encouraging promiscuity among young adults. Cue the canned laughter from western media outlets.

The thing is, moral arguments aside, they might just be right.

First of all, the research that has been conducted on the efficacy of condom usage in the prevention of sexually transmitted diseases has largely been conducted in the first world, where quality control procedures are excellent, the general health of adults is good and compliance rates are high. Under these circumstances there is no question that the spread of HIV (and other diseases) has been mitigated by the use of condoms. Companies and organizations advocating the use of condoms in the Third World wave their research papers at governments and tell then that the evidence is overwhelming. It sounds plausible and reasonable, all else being equal, but all else is not equal.

The patterns of sexual activity in Africa cannot be assumed to be the same as those in Western countries, yet people in the debate assume this none the less. The situation in Africa is very complex and it is difficult to exclude environmental factors such as changes in demographics, social habits and culture over time. War, extremes of climate, social upheaval, famine and terror inevitably affect things like the reliability of supply routes for condoms and peoples’ sexual behavior. Conducting good quality medical research in such an environment would be very difficult indeed. Results coming from studies in Third World countries cannot be considered to be of high reliability, as the degree of transparency and peer review is not equivalent to that in richer countries. Even some randomized, controlled trials in Western countries (on unrelated areas of medicine) have been shown to be completely fraudulent, making a mockery of the notion of “evidence based medicine” being the infallible guide to medical decision making.

Arguments against the use of condoms in Africa have included claims that the latex used in them is porous and permits the passage of intact virus through the membrane, or poor manufacturing and inadequate storage and transportation conditions resulting in failure of the device, and issues with compliance. These are all plausible, but they do not carry weight against the fact that, in Western countries, they do not seem to have a high failure rate at all and no class actions have been made against manufacturers for a spate of unexpected pregnancies (or HIV infections) due to failure of their product. It sometimes seems that, in this debate, once the Pope makes a pronouncement, the Catholics go out and try to find any conceivable defense of his views (not merely a moral one) to achieve compliance with Catholic teaching among Catholics (and others). They often go out and argue the case without having fully understood the contrary view. As such they have scored many an ‘own goal’ when the arguments backfire.

The AIDS problem in Africa is a behavioral and moral issue, as well as an epidemiological and medical one. Promiscuity, although a thing lauded in the First World in its music videos, movies, magazines and television programs, is the fundamental reason for the spread of sexually transmitted disease. It is the underlying cause. Secondary to this is that coexistent disease, such as malnutrition or pre-existing sexually transmitted infection, magnifies the risk of contracting or disseminating HIV. Condoms attempt to address the secondary problem. They require strict compliance in a subgroup of the population which is probably less compliant than the average.

Western AIDS campaign not addressing promiscuity

Abstinence programs were hailed by fundamentalist Christians as the answer to the teen pregnancy and sexually transmitted disease problem in the USA, but have shown to make no significant difference to either. One reason is that there are much bigger, more effective “education programs” at work there which promote extramarital sexual activity. The media is an incredibly powerful social force in the First World. This is not the case in the poorer areas of Africa where AIDS is most prevalent. The population does not undergo the same sexualization from infancy that occurs in the West. Therefore the failure of education programs in Western countries cannot be used as an argument against a similar effort in Africa. It is not correct to assume that human sexual behavior is unmodifiable. It has certainly been possible to increase the sexual activity and decrease the age of first intercourse in the First World. Why would the opposite effect be unachievable in Africa?

The AIDS problem in Africa has not been solved by Western civilization because its industrialized, technologically advanced and, dare I say it, morally bankrupt culture is not compatible with life in Africa. The imposition of Western solutions on African culture is an obviously flawed idea, yet it is exactly what continues to occur. The rampant spread of HIV in Africa can be largely attributed to the displacement of working men. Foreign industry set itself up in the cities, attracting poverty stricken farming men to find work and food for their families in the cities. Their wives and children remained in the villages. Additionally, major social upheaval in the form of civil wars, the break-down of Apartheid in South Africa and massive population shifts due to famine have resulted in the disruption of the family unit on a massive scale. Many of these disasters were brought about by the direct (albeit covert) actions of Western powers. These events create situations which make promiscuity easy, stress levels high and the likelihood of compliance with any kind of behavioral intervention (including condoms) low.

It is no surprise that the AIDS problem is nowhere near an end in Africa. The “scientific” approach to the solution through medical aid has failed. Perhaps the Catholics were right. Staying with the one sexual partner (one’s spouse) and staying with one’s family costs nothing, requires no technology and makes a society strong. Families exist because they work, because over the eons they have allowed human beings to survive hardships which would otherwise have wiped them out. Encouraging this kind of responsible behavior should be at the forefront of every intervention in the African continent, regardless of who is carrying it out. This means that trends which favor the destruction of the family unit (such as industrialization) need to be curtailed or at the very least changed so that the family unit is guaranteed to remain intact.

The paradox may very well be true, that the exact opposite approach taken in First World to counter HIV/AIDS is the correct one for sub-Saharan Africa.

Doctors and Torture

Most medical graduates do not pose in their academic garb, degree in hand before the photographer, thinking about their wonderful future career as torturers. So how can it be that some are destined for such a role?

The Standing of Doctors in Society

The medical profession is ranked very highly in western communities from the point of view of respectability. Doctors are admired for their commitment to the health and safety of their patients. This is not because of clever marketing, glossy brochures, brain-washing or any other reason other than that for many generations, the medical profession has worked hard to earn its positive reputation. The vast majority of doctors in society feel very strongly about being competent, ethical, personable and compassionate. Medical students often start out without much of an idea of just what a career in medicine entails. There is a required commitment to lifelong learning, major sacrifices asked of spouses and children, periods of intense stress and potential exposure to lethal infectious diseases. The ones who stay on, therefore, have made the choice to accept these burdens as part of their lives. Most members of the public recognize these attributes in the doctors that care for them, and the profession as a whole.

The natural medicine movement has brought conventional “Western” medicine into question as the sole arbiter of health care and how society should approach disease. It has come a long way from its early days at the fringe of society, when spiritualism and even occult practices were intertwined with traditional herbal remedies and oriental medicine. Today, much of natural medicine has gone “main stream”, and has come under the control of the very organizations its early proponents were so critical of; the pharmaceutical giants and government regulatory bodies. In many respects, natural medicine resembles a modern-day repetition of conventional medicine’s history (from a fringe, experimental art to an accepted, institutionalized and heavily regulated science). One thing that natural medicine emphasizes which is starkly contrasted in conventional medicine is its warm-hearted, whimsical and more human face. Natural medicine seems to have fewer checks and balances and less is expected of it by the public in terms of results and proven efficacy. Doctors and hospitals, on the other hand, appear colder, more systematic and industrialized. This difference in perception is a very important one, since it is nothing more than a facade. Because in both fields the providers of care are selfsame human beings, with all their faults.

Volvo - the "Doctors' Car"

Patients who have had poor outcomes from medical or surgical care, or have met doctors without personalities, or have been directly injured by negligence, are another major source of medical criticism. The pressure to be perfect is definitely felt by doctors everywhere, and horror stories of aggressive and malicious patients abound in the coffee shops and tea-rooms where doctors converse with each other. There is a fear and distrust of lawyers, litigious patients and journalists. Doctors have the tendency to practice “defensive medicine” which plays into the hands of the industries supplying the medical field (especially pharmaceutical companies). Marketing products to doctors (a generally conservative, safety conscious population of high achievers) has been worked down to a fine art and almost a science. An excellent example of this was the marketing of Volvo cars (supposedly the ‘safest’ car) to the medical profession in the 1980’s (see image). Doctors are sensitive to criticism by the public and by their peers . A doctor’s career rests on the good standing of his name, and nothing brings greater fear than to be exposed to public scandal.

Medical Ethics and Morality

To describe the guiding principles of medical practice with regards to patient care, the term “ethics” is most often used. Morality is not generally referred to due to its religious (especially Christian) connotations. Textbooks discussing medical ethics generally avoid or trivialize religious references, yet the majority of doctors are religious. This could be explained by the heterogeneous nature of the medical profession and the desire not to offend any particular sub-group, but the rejection of religious authority in medical practice has allowed medical ethics to drift away from absolutist, paternalistic principles towards a relativistic, more flexible model based on the primacy of patient autonomy. The general public does not realize that doctors do not necessarily take the Hippocratic Oath (in some countries this does not occur at all), but people are quick to take advantage of the fact that medicine has turned from being a charitable, altruistic profession to one driven by consumerism and legalism.

Despite modern medicine’s reluctance to embrace moral absolutes in its codes of conduct, there is still a strong desire among doctors to “do no harm” in all circumstances, but this is being eroded around the edges. Any side effect, failure of treatment or other adverse effect of a medical intervention is carefully weighed against perceived benefit. Opposition to euthanasia is still strong among doctors in most countries, as they recognize that crossing the boundary of saving lives to actively ending them has serious ramifications. They know that, as soon as hospital administrators learn that euthanasia is cheaper than palliative care, there will quickly be no more palliative care for those who need it. The issue of abortion is different. Here, the termination of a human life has been successfully turned into a sterile, formalized and officially sanctioned procedure. It is promoted as compassionate, just as euthanasia is, but has been easier to enact because surgical termination of pregnancy is the same procedure as that performed for a miscarriage. The pharmaceutical approach is also dressed up as ‘taking a pill to cure your ill’.

The trend to convert previously taboo procedures into legal and apparently ethical ones should be worrying to every person, even if the particular activity itself does not offend one’s personal moral code. The reason is, because the medical profession and the health industry are so powerful, so ubiquitous, that systematic errors or evils, however small, have adverse effects which are magnified and multiplied on a huge scale. This is an understated but clearly understood fact that underlies criticism of the medical profession by natural medicine proponents. Many, who are labeled conspiracy theorists, claim that from the top right to the bottom of the health system, down to the humble family doctor, there is a covert yet conscious effort to undermine society for personal gain. They are right in some ways, but wrong over all. Doctors are poorly educated in medical ethics and are not encouraged to fight for the small things that erode the moral fabric of their profession. Doctors, as a group, do have certain views and mindsets which cause them to perform systematically wrongful acts, from the point of view of moral absolutists. This is not a conspiracy but a cultural flaw. The real conspiracy, if there is one, might be found in fraudulent research and corrupted government advisories – something doctors as a whole are oblivious to and would be rightly shocked and disgusted if and when they discover it.

Terror and Torture as a Tools of Statecraft

Making the Easy Decisions

Any organism, by design, will adapt in various ways to sustain and perpetuate itself, or its own kind. Governments, as entities, are organic. While they may begin life idealistic, healthy and attractive, during the life cycle, those within government make it their task to maintain their positions of comfort and power, ultimately by whatever means necessary. As such, corruption is almost inevitable. Sustaining the system of government occurs by favoring those that support it and oppressing dissenters. Governments, like living organisms, will also attempt to spread their influence abroad and will tend to favor other governments having similar methods of self-perpetuation. It could be said that there is an association between poorly designed systems of government and the frequency and desperation of the efforts made by the governments themselves in order to maintain power.

Control by governments over an unwilling or dissatisfied population can be an expensive and failure prone undertaking. A formalized police force, judiciary and prison system are the tools for the rule of law that most members of the public are educated about and have an awareness of, but it is much cheaper and frequently more effective to use less moral methods, such as terror. Terror, in this context, is a method of government which aims to control a large population by making an example of a small, representative sample. In many countries it is exercised overtly, but most governments prefer to keep this side of their activities quiet in order to maintain a public and international face of decency and moral superiority. For an eye-opening historical account of some of this type of history of unconventional methods of government, Instruments of Statecraft is a worthy read.

Torture is a particularly nefarious form of unconventional statecraft which has a threefold function. Firstly, it is used to extract sensitive information from suspects. Secondly, it is used for the gratification of the torturers and in revenge for perceived grievances. Thirdly, it is used to instill fear into the public, especially when victims are released back into their communities and tell of their harrowing experiences. Naturally, governments try to justify the practice of torture by claiming that it is in the public interest, particularly with regard to public ‘security’. In modern times, many otherwise respectable nations have either legalized or admitted to having conducted torture on criminal suspects. Here is a summary of nations as listed in Wikipedia:

- Afghanistan – A long history of torture and presently allegations of torture are aimed at both sides of the United States / Taliban conflict.

- Albania – Torture under previous regimes and allegations of same by police under the current regime.

- Algeria – Historically practiced by the French Foreign Legion, and since then to the present during what is called the ‘Dirty War‘.

- Angola – As part of a government war against Cabindan seperatists.

- Argentina – Historically, during the 1970’s ‘Dirty War’.

- Brazil – As part of efforts by government to manage the illegal drug trade, both to interrogate suspects and punish the convicted.

- Chile – Famously practiced by the regime of Augusto Pinochet during the 1970’s.

- China – Outlawed only in 1996, however still widespread.

- France – Historically practiced in several of its colonies (if not all of them), however within France there are many and frequent allegations of torture by police, as recently as 2005.

- Germany – Once commonplace in East Germany, allegations of systematic torture since that time have not since arisen.

- Iraq – Practiced by the now deposed Baathist regim, only to see its widespread resurgence under US occupation. The US Government has been directly involved at the highest levels, as is the Iraqi Government.

- Israel – A long history of torture allegations exists. Torture was legalized in Israel in 1987 (with Palestinians in mind) but outlawed in 1999. Allegations of torture before and after this time abound, both domestically and abroad.

- Nigeria – Systematic and ongoing.

- Russia – Officially illegal. Torture, however, was used in the war against Chechnya. It is said to be widespread domestically.

- Saudi Arabia – While illegal, Amnesty International describes torture in this country ‘rife’.

- Spain – Many allegations of police brutality exist, particularly in relation to anti-terrorist activity.

- United Kingdom – Extensive history, widely covered.

- United States – Extensive history, widely covered.

- Uzbekistan – Allegations of widespread torture exist. Information obtained during torture has been used in investigations by Britain and other democratic countries.

The number of countries condoning torture is much longer and by its very nature, the story of torture is a hidden history. We can be sure that whatever can be found out about torture, there is much more that remains unknown. When reading about reports of torture, it can be assumed that the information is merely scratching the surface on the issue.

Torture is not a haphazard, spontaneous or undisciplined form of violence. Rather, it is an established international industry. Businesses (and governmental departments) are set up to train personnel, sell equipment, and produce entertainment to promote the torture culture:

Chomsky and Herman also point to the international side of torture, including the arms suppliers, the various foreign governments that provide training, and the way torture complexes interact on a global scale. (How Not To Talk About Torture, Ch. III)

The reasons for torture programs are not purely economic, but the system is driven in part by money. It is clear from the list given above that the nations concerned were not conducting torture in order to produce a cheap labor force but to neutralize opposition to whatever agenda the nations are pursuing. Obtaining information is not the only reason for torture. As such, evidence showing that information obtained from questioning torture victims has poor reliability will not make torture obsolete.

The precise methods and details of the practice of torture are occasionally covered in the mainstream media, but it is usually up to activist organizations to pick up the slack in this regard. Corroborating evidence abounds, and it is surprising how little attention is given to the issue of torture on the international stage by politicians who seem all too willing to turn a blind eye for economic gain. The immediate aim of torture is to destroy the victim as a human being, but not to cause death. As such, a fine line is trod, since physical methods are employed to achieve psychological ends. The torture methods themselves are often designed to leave no physical evidence on the victim’s body. Victims may need ‘rehabilitation’ prior to release to the public, which may involve a period of rest and nutrition. If the victim is injured, particularly if this occurs in a setting where torture is not supposed to take place officially, medical attention is sought. Frequently medical involvement is inadvertent, but there is a more ugly and more deliberate place for doctors in torture.

So it becomes clear that doctors (and other health professionals) are called upon to assist at various stages of the torture process. These are people, trained in public universities, of good standing in the general community, who, one way or another, have come to participate in some of the worst imaginable crimes. In many cases, the doctors become the torturers, participating fully and willingly in these heinous acts. How is this possible?

Boiling The Frog: How Doctors Get Involved in Torture

Most medical graduates do not pose in their academic garb, degree in hand before the photographer, thinking about their wonderful future career as torturers. The paths that lead to this endpoint are many, but not all are accidental. Indeed, as frequent as torture is, as many as half of victims will have had a doctor present during their ordeal.

Accounts of how doctors assist during torture describe a variety of roles, ranging from ‘patching up’ injuries inflicted on victims so that the victims can undergo further abuse, supervision and guidance of torture to the fully fledged participation in torture. Doctors have also been involved in conducting medical research on detainees, including in the setting of torture. How do they end up involved in all of this?

The fact is, abuses in medical practice lie on a continuum, as they do in any other occupation. Doctors, being human, cannot be expected to be perfect. Indeed, cases of medical misconduct by doctors have always been a combination of an unscrupulous administration, an unreasonable work environment and a morally weak (or weakened) doctor. In a letter published in the New England Journal of Medicine, it was stated:

The doctors thus brought a medical component to what I call an “atrocity-producing situation” — one so structured, psychologically and militarily, that ordinary people can readily engage in atrocities. Even without directly participating in the abuse, doctors may have become socialized to an environment of torture and by virtue of their medical authority helped sustain it. In studying various forms of medical abuse, I have found that the participation of doctors can confer an aura of legitimacy and can even create an illusion of therapy and healing.

What became clear in the Abu Ghraib torture scandal during the US invasion of Iraq, was that the US Administration had anticipated, planned and authorized the abuses. This occurred, more or less, from the highest levels of authority downwards. No doubt, individuals working at the prison believed that they were some how protected from being exposed or prosecuted because of this chain of authority.

It is not difficult to imagine a hypothetical situation where a doctor, perhaps one who is employed in a prison, is called to attend to an injured prisoner involved in a scuffle with a guard. It is reasonable to assume that the doctor is not without ambition and would like a comfortable career both within the military and in the community afterwards. As such, this doctor would hope to have cordial relations with his fellow staff. He could probably be coaxed into performing one or another small but incriminating act, such as stitching up a laceration on a prisoner inflicted by a guard without reporting it to the relevant authorities. It has frequently been the case around the world that institutions, such as prisons, have been used as the cover for a torture program. So, it is not difficult to imagine our good natured, well intentioned doctor being asked to help out in a special interrogation, perhaps in connection with a ‘highly secret mission’ of some kind, authorized at the highest levels. The doctor’s job might be merely to make sure the prisoner is not hurt… much. It might be put to the doctor that until now, nobody was supervising this activity (since it was so secret) and prisoners’ lives were put at risk. As such, the doctor may initially think he is being invited to be the prisoner’s advocate. Add to this tempting offers of increased pay, promotion and ‘whatever’ else the doctor wants, with some kind of subtle reminder of what the doctor stands to lose. This combination of fear, greed and lust is a common and time proven method used to corrupt individuals. It probably works more times than it fails.

Once a doctor agrees to this, there is no turning back. He has given himself entirely to blackmail and while it is easy to imagine how the doctor might at some point develop cold feet and no longer wish to be involved, the organization conducting the torture will have foreseen it. At this point the doctor will have placed his life and that of his family at risk. There are, of course, a multitude of other ways that a doctor may be ensnared into participation in torture.

Thus, not all environments which are “atrocity producing situations” need to appear as such. A well documented example is that of the Soviet psychiatric system, where political prisoners were detained and abused under false psychiatric diagnoses:

The treatment included various forms of restraint, electric shocks, electromagnetic torture, radiation torture, entrapment, servitude, a range of drugs (such as narcotics, tranquilizers, and insulin) that cause long lasting side effects, and sometimes involved beatings. Nekipelov describes inhuman uses of medical procedures such as lumbar punctures.

These abuses occurred in prominent public buildings which were otherwise used to treat genuine patients. It is alleged (and very likely) that many of the systems of abuse which existed in the Soviet era have not ceased operation, but merely serve new masters.

The Psychology of the Torturer

The Milgram Experiment is used to explain how an individual may be brought to act against his or her conscience to harm another individual, under the direction of an authority figure. It has its faults and confounding factors, but the study elegantly shows how easily people can be led to an immoral act through an otherwise virtuous motive, in this case obedience. The author stated:

Ordinary people, simply doing their jobs, and without any particular hostility on their part, can become agents in a terrible destructive process. Moreover, even when the destructive effects of their work become patently clear, and they are asked to carry out actions incompatible with fundamental standards of morality, relatively few people have the resources needed to resist authority.

Making people commit evil acts is apparently a pretty easy task. In addition to obedience to authority, other psychological tools such as dehumanization, sexualization, religious duty, and telling torturers falsehoods about the victim are employed. Once a torturer has overcome his moral inhibitions (of which there may have been none to begin with), getting him to enjoy it is usually only a matter of time. The reason is that many of the basic human desires are fulfilled in the act of punishment, particularly the desire for control and power over others. Many torturers also obtain sexual gratification from their work. It is easy to see how torturers can lose all sense of proportion and become a danger to people besides the designated victims.

There are even public attempts to justify torture, as if to encourage those already committing it. For example, the rather pathetic argument of the ‘ticking time bomb’, where a person is tortured to extract urgent information that would supposedly save many lives, is in reality a fictitious one, yet it was enough to convince a democratic parliament to pass a law permitting torture.

The public is led to believe that torture is about extracting information, but in fact torture serves many other roles, as we have described already. However, torturers, like the public, believe what they want to believe:

“When torture takes place, people believe they are on the high moral ground, that the nation is under threat and they are the front line protecting the nation, and people will be grateful for what they are doing,”

Being a torturer can almost be made out to be the dream career choice: save your nation, feel powerful, take your frustrations out on a subhuman (who deserves it anyway), please your deity, live out your secret sexual fetish, get paid a heap of money and rise in social standing. Sadly, in such a job advertisement there would be thousands of applicants.

A doctor is involved, in part, to temper the torture process so that the physiological limits of the victim are not breached, by interpreting physiological monitoring devices, assessing consciousness, and maintaining the victim’s vital parameters. As such, the doctor may feel he is doing the right thing, doing his regular job and feeling powerful in his own way. Being human, the doctor will also find gratification from all of the other psychological factors which favor the torture behavior. The doctor will find it difficult to reject the cognitive dissonance which confronts him, namely that his actions perpetuate intense and senseless suffering, yet prevent death.

Conclusion: The Prevention of Torture

The most important thing a doctor can do is refuse to participate in a system that abuses people, be they prisoners, detainees, or poorly behaved patients. The problem is that “relatively few people have the resources needed to resist authority”. While many doctors are strong leaders, many are relatively docile and belong to an authoritarian system. Ask any intern what he or she would really do if ordered to perform a wrongful act on a patient by a supervising doctor. There is a good chance that the wrongful act would duly take place, unless the intern was already trained in recognizing and managing such a situation effectively.

Sadly, in many countries where torture is rife, doctors are themselves afraid of imprisonment and abuse, should they become activists for the abolition of torture. In their case, it is up to doctors abroad who interact with members of the said countries to do their part in pressuring governments to outlaw the practice and protect those who expose incidents of torture.

Even in the western world, it is a fact that there is grave lack of clear understanding among doctors of where the limits lie with respect to the treatment of patients (or detainees). Medical schools and medical students tend to view medical ethics as a low priority, whereas in reality a sound knowledge of medical ethics is the secret to a good night’s sleep for a doctor, a thing that no amount of money can otherwise buy.

It is clear, therefore, that prevention of medical participation in torture begins in the education, training and management of the medical profession as a whole, particularly in areas where doctors are likely to treat patients whose care is not altogether voluntary (the mentally ill, the elderly, prisoners, etc.). It cannot be restated enough times that a doctor needs to feel justified in refusing to do the wrong thing. The word ‘torture’ needs to be brought into the public limelight. There must be no compromise on the intrinsic wrongfulness of torture in any circumstance.

The Medical Foundation for Care of The Victims of Torture suggests:

“The solutions include exposing and prosecuting members of the security services who still use unnecessary or disproportionate force in handling suspects and detainees,” he says. “This requires multi-agency action, and healthcare professionals can play an essential part in the process with the careful assessment and documentation of evidence of ill-treatment.”

I would add to this that doctors need to be educated, as part of their psychiatry terms, in recognizing the physical and psychological signs which suggest that patients may have been abused or tortured.

So it is, that by refusing to participate, recognizing abuse, documenting and then exposing the perpetrators, that doctors can go some way to undo the wrongs done by their peers and by the system in which they work.

Engulf and Devour

Silent Movie

In the Times Online we read:

More aggressive, concerted efforts are needed by key economies to quell financial market stresses if the world is to avoid an even sharper and longer recession, the International Monetary Fund urged today.

Let’s face it, economic catastrophe is unavoidable and was foreseen by many (including those in power) for a long time. The IMF pretends to care, but we know that deep down it favors a single world currency (presumably with itself at the helm). There seems to be a race to get this single currency concept off the ground, with China and Russia also vying for the “top job”. But for ordinary people, a single planetary currency (with its obligatory single World Government) is nothing but a guarantee of Universal Mediocrity. The reasons the world is sick financially is because of Internationalism, not for the lack of it.

In the Mel Brooks film “Silent Movie”, the “Engulf and Devour Corporation” steals the film just before it is previewed. It is a parody of the Gulf & Western company, notorious for its aggressive business practices, hostile takeovers, asset evisceration and so on. It was an example of a highly immoral business in terms of how it treated its assets (companies it owned and its employees). The history of the company has been covered from several aspects and its business methods analyzed in detail:

The imperial conglomerate has wholly owned subsidiaries in unrelated industries. In theory, the conglomerate can use cash generated by operations in some areas to diversify into other areas that might provide counter cyclical market risk reduction.

Actually, these mega-corporations are like huge monsters which destroy smaller, independent companies by taking them over, bleeding them dry (particularly to cover the losses of other companies) and then selling the left-over carcass of a company to some other sucker-company. Some more of this excellent analysis is worth quoting:

In other words, a great many of America’s largest companies are de facto hedge funds. Their “diversification” (Peter Lynch preferred the term “di-worse-ification”) resembles that of imperial conglomerates. This is not exactly good news for a country with out of control debt growth and intractable balance of trade deficits linked to declining product competitiveness.

…

The size, prestige, and complexity created by cobbling many firms together into a large conglomerate often provides enough maneuvering room to subtly and cleverly plunder shareholders while real underlying wealth-creating performance actually declines (and malinvestment rises). As part of their sorcerer’s bag of tricks, imperial conglomerators typically have enough cash flow to pay for big ad budgets, big consulting fees, major lobbyist services, and big transaction costs. All of this helps to bribe elements of the media, academia, the consulting profession, Washington, and Wall Street into saying nice things about them.

Having too much under one umbrella company is not good for the world, let alone America. A single world currency would bring this about in its most extreme form, as what it really means is a single World Central Bank, with a single Director. It will be the Monster to end all monsters, if it ever comes about.

This is the situation where Capitalism will converge with International Socialism to create the worst form of government the world will ever see. When no nation is independent from the other (politically and financially), when the world’s economy is centrally governed (with politics to follow suit), there will be only one way to march. Yes, there will be “stability”. Yes, there will probably be no more wars between subscribing countries. But there will be no way to stop “scientific government policy” such as forced population reduction, suppression of religion and free speech.

You will smile and you will enjoy it, or else.

The Character of a Happy Life

Henry Wotton

How happy is he born or taught

That serveth not another’s will;

Whos armour is his honest thought,

And simple truth his highest skill!

Whose passions not his masters are;

Whose soul is still prepared for death,

Untied unto the world with care

For princely love or vulgar breath;

Who envies none that chance doth raise,

Nor vice; who never understood

How deepest wounds are given with praise;

Nor rules of state, but rules of good;

Who hath his life from rumours freed;

Whose conscience is his strong retreat;

Whose state can neither flatters feed,

Nor ruin make oppressors great;

Who God doth late and early pray

More of His grace than gifts to lend;

And entertains the harmless day

With a good book or friend;

– This man is freed from servile bands

Of hope to rise or fear to fall:

Lord of himself, though not of lands,

And having nothing, he hath all.

– Sir Hentry Wotton (1568-1639)